>> “Climate Solutions” is also available as a podcast and an e-book.

By Aldo Romani

When Zilu asked Confucius what his first priority would be if he were entrusted with the government of the state, the master replied, “To rectify names.” The key to good government, Confucius tells us, is that words should mean the same thing to everyone. This applies to capital markets, too: investor confidence relies on clear rules and definitions.

The last global financial crisis undermined the credibility of finance and plunged it into a deep crisis of legitimacy. Arjun Appadurai has identified the origin of this crisis in a “failure of language” caused by derivative finance. Finance must now re-establish trust by building confidence in the promises it makes on the green use of capital.

If we are to boost support for projects that truly fight climate change and protect the environment, we need to make sure that we develop a common language for green finance. Only then can investors know that they are buying something truly “green” and understand the impact of their money. This is even truer in another essential and still largely unchartered dimension of sustainable investment: “social” investment.

The good news is that Europe is moving towards this common language. An EU classification of sustainable financial instruments based on the sustainability of the underlying economic activities is at the heart of the European Commission’s Action Plan on Financing Sustainable Growth. This EU Sustainability Taxonomy will measure how the financed activities contribute to sustainable objectives in a more reliable and comparable manner.

When adopted, the Taxonomy will provide a shared definition of core aspects of sustainability, so that a consistent set of standards can be developed for sustainable investment (for example, green loans and green bonds). That is vital to ensure that policy signals as well as issuer and investor disclosures can be used as a basis for conscious and informed decisions in the market. It is also essential to ensure that competition is fair and effective, so that real value is produced for society.

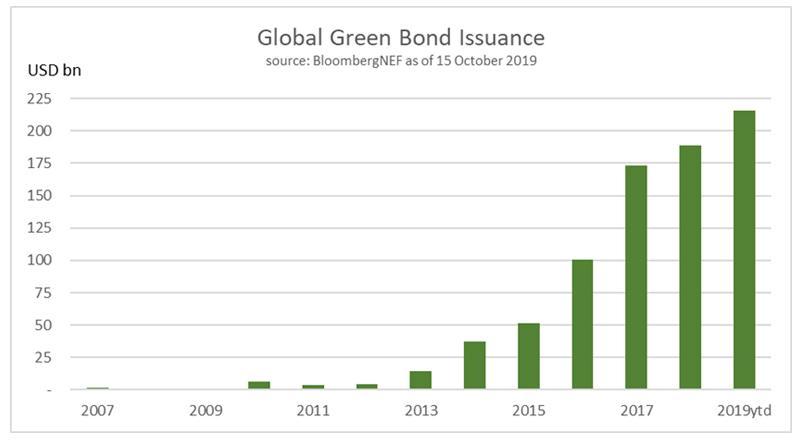

The development of the green and sustainable bond market, inaugurated by the European Investment Bank in 2007, is particularly significant here, since this market moves faster than other product segments and acts on expectations rather than in a backward-looking perspective. It is, therefore, particularly effective in shedding light on sustainability objectives and their actual implementation on the ground.

Green bond market potential

Driven by investor demand for clarity, the green bond market has already shown its potential, developing to over €700bn in little more than a decade, with exponential growth in the past five years. Further growth, which is directly linked to the expansion of loans and other investments that are eligible for allocation from the bonds, is key to our chances of developing a sustainable economy with the help of finance.