4. How the system of cities evolved: adaptation and investment in European cities

4.1 Cycles of development and investment in Europe’s cities.

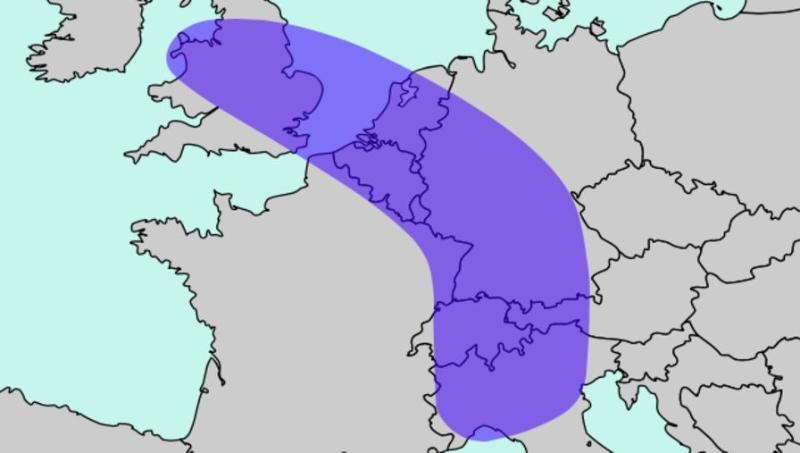

How, then, have European cities managed to bounce back from demographic and economic decline? And what was it that enabled them to break free of national hierarchies and re-organise themselves into a new system based around concentrated clusters and flows?

The answer to these questions, at least in part, lies with investment. European cities initially used investment to encourage growth and reverse city-centre decline. Later, investment was directed towards regional specialisms and new industries, such as technology and innovation. This helped to establish the current system.

The first cycle of European urban investment: 1980s – 2000s

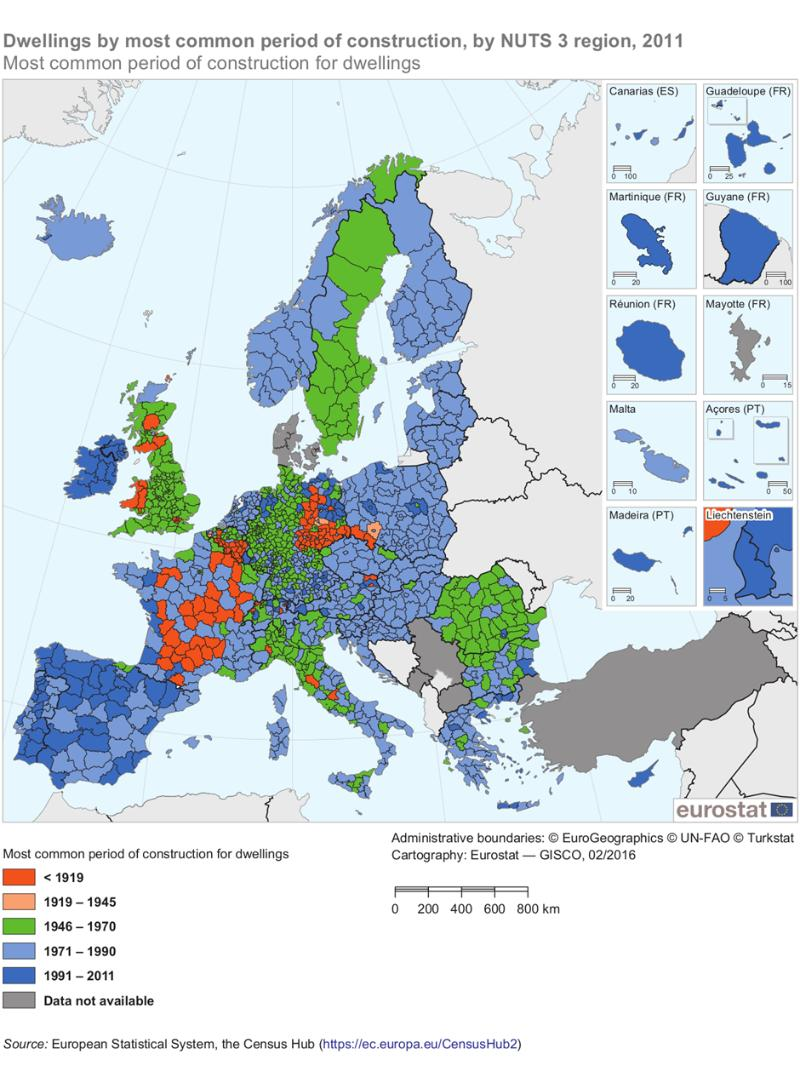

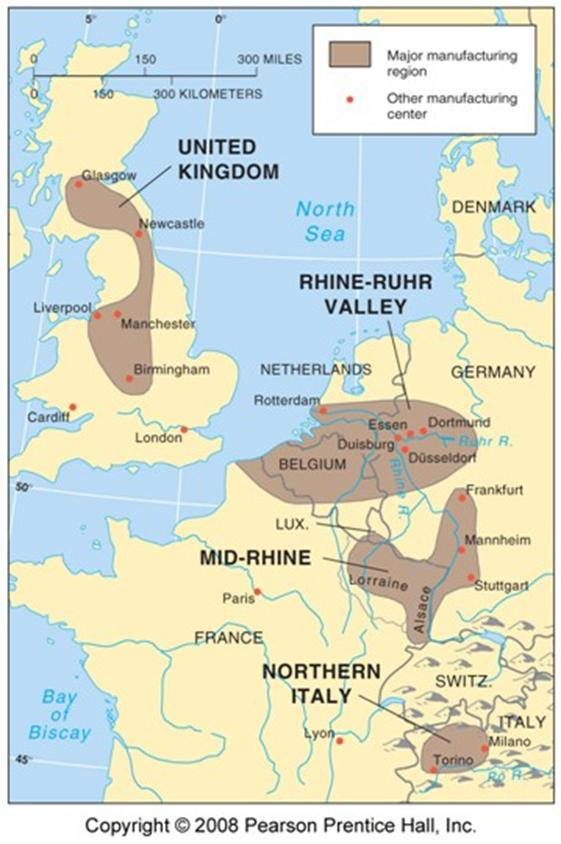

Beginning in the 1980s, cities invested in large-scale regeneration programmes as a means of encouraging city-centre growth. In many instances, cities leveraged their immense but dilapidated civic assets, including town halls, public libraries, universities, parks and public squares, to redevelop their heritage and culture. [57]

Old civic buildings were restored, industrial properties reused, and popular pedestrian zones created. Cities also actively supported the start-up of new service businesses through the provision of incubator spaces and the repurposing of old and abandoned sites. This, in turn, generated a new economic climate that favoured the private sector and created new jobs. Consequently, the physical environment improved, residents moved back to the city centre, reversing the decades-long decline. [58]

Government leadership was essential, providing funding support for the transformation of physical assets, as well as the resources for large-scale recovery programmes. [59] However, one of the main reasons that urban regeneration was so successful was that it attracted into city governments skills from the private sector to help make the investment a reality. [60] Without private sector support, many of the far-reaching transformations that characterised the 1980s and 1990s – including Barcelona, the London Docklands, and the Manchester central business district – would not have been possible.

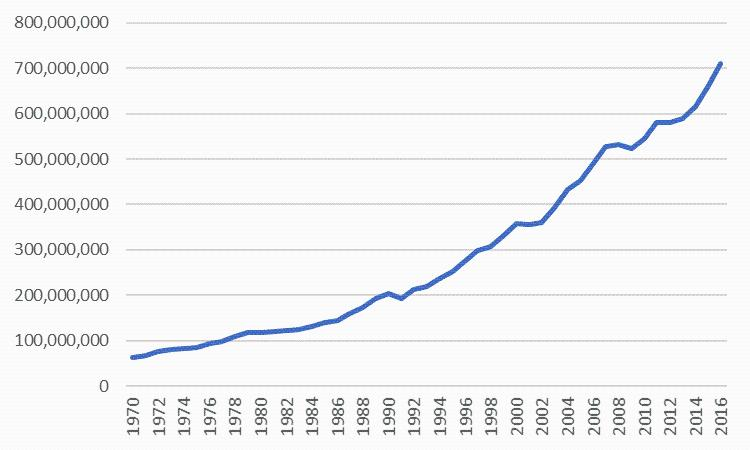

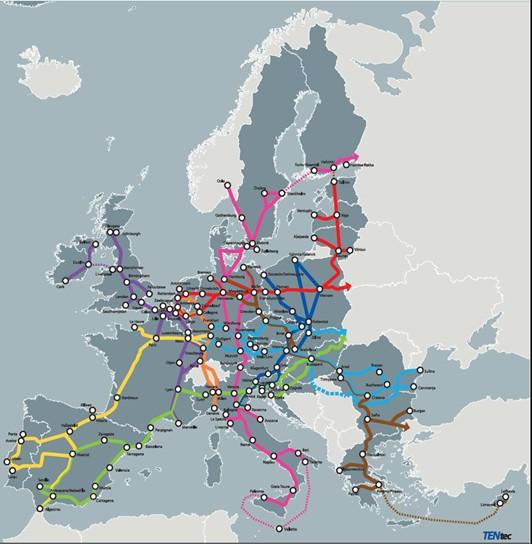

Cities also invested heavily in transport infrastructure. Major upgrading of public transport systems aimed at overcoming the dominance of traffic and the continued expansion of roads. It also aimed at unlocking new districts, increasing productivity and improving air quality. Over the past few decades, European cities have invested primarily in improving the coordination of public transport services. The first fully integrated public transport system was the Verkehrsverbund, established in Hamburg in 1967. Between 1970 and 2000 most large cities developed similar systems, with coordinated services and fares. [61]

But cities have also invested in modernising and expanding their public transport services. Modern equipment replaced almost all rolling stock, and new stations, tracks and guidance systems expanded and modernised rail infrastructure. Improvements in the quantity and quality of public transport services, together with low fares, have led to considerable growth in public transport use in European cities over the past few decades, particularly in western EU cities: a 39% increase in passenger kilometres for metro and tram, 38% for rail, and 11% for bus. [62]

The second cycle of European urban investment: 2000s-

Since the 2000s, cities have also invested in technology and innovation to enhance competitiveness. One of the thematic objectives of EU Cohesion Policy during the 2014-2020 period is to enhance access to, and the use and quality of information and communications technology, including developing products and services and strengthening applications. The EU eGovernment Action Plan (2016-2020) currently sets out concrete actions to accelerate the implementation of existing legislation and the related uptake of online services. [63]

Investment is also increasingly directed towards the climate action and environmental agenda. For several decades, cities were seen as environmental problems, and urban policies throughout Europe focused primarily on poverty, crime, and urban decay. Recently, climate change and the environment rapidly climbed the urban agenda, as European governments started to set tougher and more ambitious targets. COP21, the UN Conference of Parties climate meeting in Paris in 2015, was a key milestone, demonstrating the widespread recognition of cities as global solutions. [64]

Over the past decade, cities have come to occupy a central role in the global response to climate change. Several cities, investing in their industrial and engineering expertise, have become pioneers of new environmental industries. Many cities, including Stockholm, Berlin and London, have also begun to decouple economic prosperity from increasing levels of resource consumption, in what is increasingly seen as a fundamental component of a sustainable European urban future. [65]

The European Commission is particularly committed to putting in place the necessary reforms to give incentives to the financial sector to contribute to this “green transition”. The Investment Plan for Europe – the Juncker Plan – has already generated considerable investment and has mobilised several other sources of European financing, including the structural funds, to fund numerous projects in the fields of energy efficiency, renewable energies and the circular economy. [66]

4.2 Financing Europe’s cities.

Where has the funding come from?

Both national governments and cities have an important role to play. On one hand, attracting external capital investment is not yet a core responsibility of all city governments and there are gaps in the competencies, capacity and skills of city governments to undertake such tasks. In Europe, city governments do not generally have the same degree of fiscal and financial freedom as cities in North America. Even cities in more devolved national systems do not have the capacity to single-handedly meet all of their investment needs. [67] On the other hand, national governments have committed themselves to external fiscal disciplines (such as the Stability Pact/Maastricht Principles for Euro membership), which means they cannot easily raise the rate of public investment through public debt.

In Europe, municipalities mainly resort to their own resources to finance infrastructure investment, which accounts for 50% of financing. This is followed by transfers from national and sub-national governments (23%), external finance including bank loans (18%), and EU funding, including EU structural funds (8%). [68]

Trends in European urban investment

It is increasingly recognised that achieving EU policy goals is only possible if Europe’s cities are fully engaged in attaining their own long-term success. To achieve this, development and investment requirements must be met. This imperative has resulted in a notable trend towards the private sector becoming more involved in investment.

In most cases of successful city investment over the past five decades, public and private capital have played complementary roles. It has gradually become clear that private investment is essential to bridge the numerical gap in financing, as well as to add market discipline, raise the quality of the deliverable, and demonstrate to investors that the city is attractive. [69]

The “investment gap”

Over the past five years, 42% of EU municipalities have reported an increase in investment activity. [70] But although cities are attracting investment effectively—and in a way that generates both a reasonable internal and external rate of return—this does not mean that all European cities have all the investment that they need or would like. Indeed, there is still an “investment gap” in cities throughout Europe.

This gap, however, is more than just a capital gap. It is also:

- An institutional framework gap – returns on public investments are expected over short timescales, giving rise to shorter pay-back periods that are not always realistic and do not provide the right incentive for large-scale public investment.

- A collaboration gap – lack of coordination between different public bodies active in the same cities, plus the fact that PPPs and other methods of investment delivery have not yet evolved to be comprehensively applicable or universally trusted.

- A knowledge gap – lack of knowledge among public and private actors about how each other works and what is required for effective collaboration, plus information gaps on available investment opportunities. [71]

New directions in European urban investment

In an attempt to overcome this investment gap, several new strategies for better capitalisation have been put forward. In the last ten years in particular, there has been a renewed focus on increasing investment flows. Several key innovations stand out.

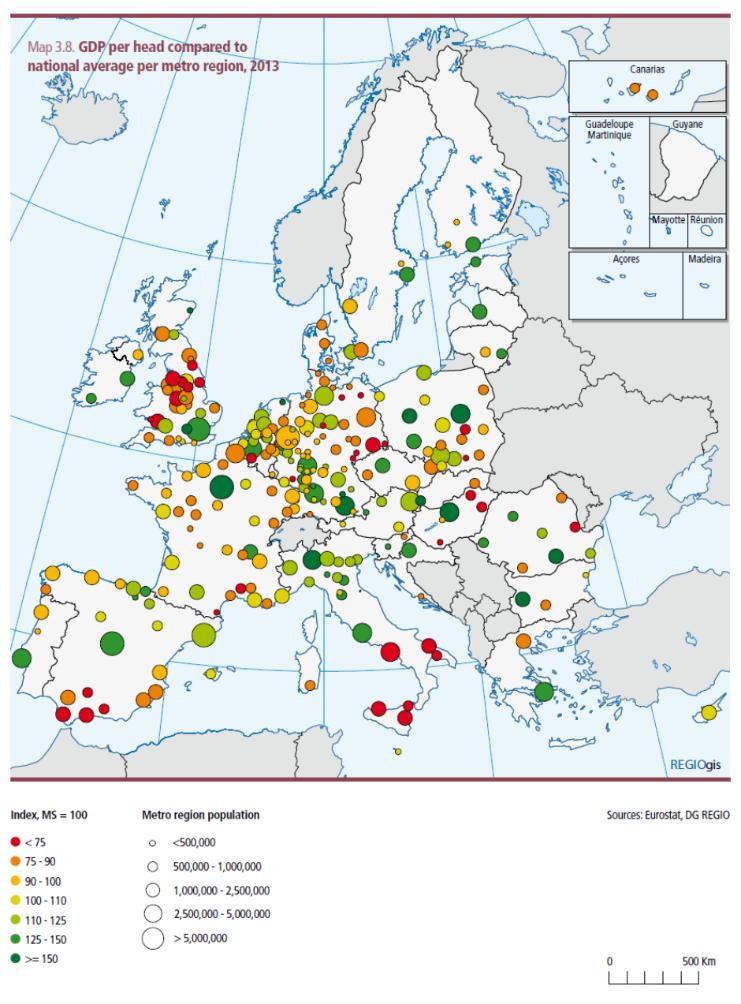

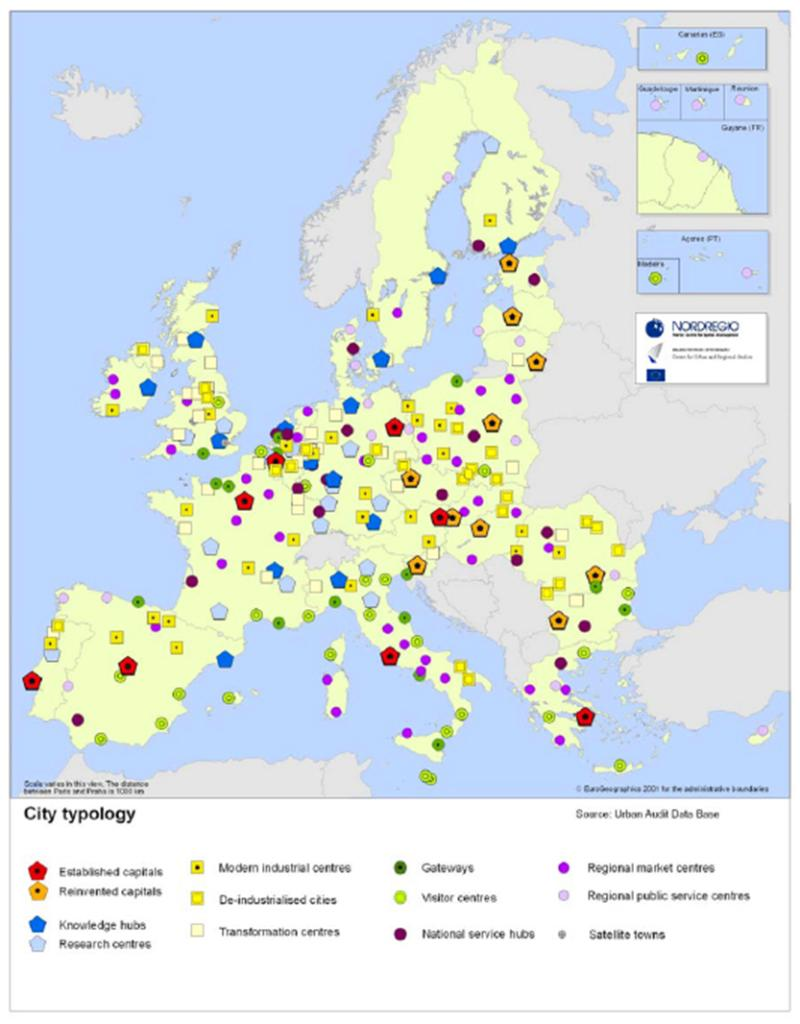

Firstly, there has been an increased focus on bankability, meaning that the likelihood of profit is more reliable. Institutions are helping cities to become more bankable by allowing them to develop advanced asset management and corporate finance systems. Partly, this is based on the recognition that different types of cities have different types of investment gaps, and therefore require different strategies. As the European system of cities has become more differentiated, it has also become apparent that different kinds of cities are on distinctive journeys and need investment that supports their distinctive needs. Knowledge hubs, for example, experience different types of investment gaps to research centres, and require different investment strategies to close these gaps. [72]

Emphasis has also been placed on helping cities to develop sound fiscal strategies. This is the first step in building the necessary foundation of trust that will enable cities to promote themselves in such a way as to engender confidence among financiers.

Secondly, different forms of lending are coming to the fore. Aside from traditional bank loans, longer-term, structured financing techniques, such as bond financing, are rapidly gaining in popularity. These new forms of lending have been enabled by the emergence of new lending instruments and tools, such as revolving loans, and guarantees and incentives, which are increasingly used to lower the risks of private investment.