European Investment Bank (EIB) Vice-President Ambroise Fayolle and Commissioner for the Internal Market, Industry, Entrepreneurship and SMEs Elżbieta Bieńkowska took the opportunity of the 11th Conference on European Space Policy to present a new report on “The future of the European space sector”. The report, produced by the joint European Commission–EIB initiatives InnovFin Advisory and European Investment Advisory Hub, established under Horizon 2020 and the Investment Plan for Europe respectively, assesses the current investment landscape in the space industry, identifies gaps in financing and proposes key recommendations and solutions to improve the existing conditions.

“The EIB’s latest report on financing advances in technologies highlights the disruptive forces transforming the space sector that are challenging old and new players alike. It gives a clear roadmap on how we can leverage our current public financial support schemes at national and EU levels to crowd in the much needed private capital,” said EIB Vice-President Ambroise Fayolle, responsible for innovation.

"Access to finance remains a significant hurdle to unleashing the potential of European space entrepreneurship within and outside Europe. In the 2016 Space Strategy for Europe the Commission therefore set out financing as a strategic area. And indeed we gave financing particular attention in the EU Space Programme for the next budget period from 2021 to 2027. The EU Space Programme in synergy with Horizon Europe and InvestEU will pave the way toward a coherent and integrated suite of dedicated funding instruments for space companies in Europe. We need to work seamlessly from the idea to business development. to reinforce the space ecosystem. The insights of today's report will help us to design and roll-out smart financing to stimulate more investments for space in Europe. This is a key contribution to a European approach to New Space." underlined Commissioner Elżbieta Bieńkowska.

Finance and the European space sector

The report finds that the European space sector encounters funding hurdles, similar to those of other tech sectors, particularly at the growth and commercialisation phase. European space entrepreneurs seek financing especially for R&D and product development and prefer venture capital or private equity as sources of funding. However, they feel that there is a lack of such sources, with only a limited number of existing European space funds. They therefore keep an eye on funding opportunities outside the EU. Notably in the US, funding rounds are larger and investors with higher risk appetite are enticing to European firms. The scarcity of scale-up funding in Europe is a critical shortfall, which often leads to the flight of talent and companies.

Compared to the private sector the European public funding landscape is relatively strong. European space companies emphasise the crucial role that public innovation instruments play. 40% of the companies surveyed in the report seek public funding to unlock private investment. However, entrepreneurs find it difficult to navigate through the different possible funding options, as a coherent and integrated suite of dedicated funding instruments for space companies is missing.

Overall, the report concludes, the investment landscape in Europe is sub-optimal and makes the commercialisation of space technologies difficult while not capitalising on the R&D investments made.

Read the full report here.

Key recommendations to boost the European space sector

The report recommends strengthening the space ecosystem in Europe by making public support more flexible and better oriented towards commercialisation. EU institutions should, therefore, focus on enabling better access to risk capital and catalysing additional private investment, drawing from the experience with the European Fund for Strategic Investments (EFSI), which has helped to unlock over EUR 370 billion of investment for strategic and innovative projects in Europe in the last three and a half years.

A further recommendation of the report is to set up a “finance for space” forum with representatives from the finance community, academia, policymakers and industry to develop innovative financing solutions, as the space sector lacks knowledge about finance and finance lacks knowledge about space. A regular forum could help bridge the information gap by convening key stakeholders, identifying specific financing needs, and discussing and developing potentially new funding models and (co-)financing solutions.

Why space matters

The global space economy reached EUR 309 billion in 2017, having grown on average by 6.7% p.a. between 2005 and 2017. This is almost twice the average yearly growth of the global economy of 3.5%. One aspect that has contributed to this growth has been “NewSpace”. a global trend consisting of a series of technological and business model innovations that have led to a significant reduction in costs and have resulted in the provision of new products and services that have broadened the existing customer base.

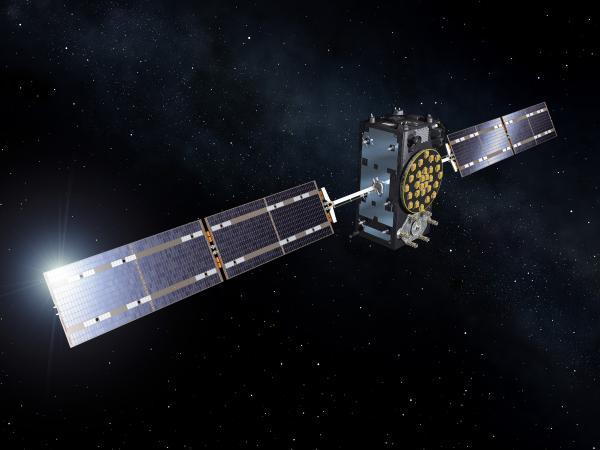

Europe has historically been at the forefront of space exploration, investing massively in space infrastructures such as the Copernicus and Galileo programmes. It still boasts academic and scientific excellence but, as the EIB report highlights, it is at risk of missing the next wave of space innovation unless it seizes the opportunity to stimulate more investment in the new space sector.

However, not only high growth rates matter. So far, the European space sector has helped to improve lives in many ways:

- Responding to natural disasters: In 2017, Copernicus maps showing the extent and magnitude of damage helped rescue teams deal with forest fires (Italy, Spain, Greece and Portugal), earthquakes (Mexico), hurricanes (countries hit by hurricanes Harvey, Irma and Maria), and floods (Ireland, Germany), amongst others.

- Saving lives at sea: Copernicus supports the European Border and Coast Guard Agency's missions in the Mediterranean, helping spot unsafe vessels and rescuing people. Galileo can be used on all merchant vessels worldwide, bringing increased accuracy and more resilient positioning for safer navigation.

- Search and rescue: A new Galileo service reduces the time it takes to detect a person equipped with a distress beacon to less than 10 minutes in a variety of locations including at sea, in mountains or deserts, and in urban areas.

- Monitoring oil spills: The European Maritime Safety Agency (EMSA) uses Copernicus data for oil spill and vessel monitoring.

- Landing of airplanes: 350 airports in almost all EU countries are currently using EGNOS, making landing in difficult weather conditions more secure, thus avoiding delays and re-routing.

- Road safety: Since April 2018, Galileo has been integrated into every new car model sold in Europe, supporting the eCall emergency response system. From 2019, it will be integrated into lorries’ digital tachographs to ensure that driving time rules are observed and to improve road safety.

- Agriculture: 80% of farmers using satellite navigation for precision farming are EGNOS users. And Copernicus data is used for crop monitoring and yield forecasting.

Background information

Under Horizon 2020, the EU research and innovation programme for 2014-2020, the European Commission and the EIB Group (EIB and EIF) have launched a new generation of financial products and advisory services to help innovative firms access finance more easily. InnovFin – EU Finance for Innovators offers a range of tailored products which will make more than EUR 15 billion of financing support for research and innovation (R&I) available to small, medium-sized and large companies and the promoters of research infrastructures. This finance is expected to support up to EUR 48 billion of final research and innovation investments.

InnovFin Advisory, a joint European Commission-EIB initiative under Horizon 2020, aims to improve the 'bankability' and investment-readiness of projects that need substantial, long-term investments. It also provides advice to improve the conditions for access to risk finance for R&I and advises on the setting-up of thematic investment platforms. The main clients anticipated are promoters of R&I projects that address Horizon 2020 Societal Challenges. InnovFin Advisory has a large portfolio of horizontal activities and a strong track record in advising innovative companies to enhance access to EIB and/or other financing.

The European Investment Advisory Hub is a joint initiative of the European Commission and the European Investment Bank under the Investment Plan for Europe. The Hub provides access to a number of advisory and technical assistance programmes and initiatives, including through its network of partner institutions. Project promoters, public authorities and private companies can receive technical support to help get their projects off the ground, make them investment-ready, gain advice on suitable funding sources, and access a unique range of technical and financial expertise.