- Annual shortfall of up to €10 billion in investments to keep the European Union in the global artificial intelligence and blockchain race.

- The European Union only accounts for 7% of annual equity investments in both technologies, while the United States and China together account for 80%.

- However, the European Union excels in research related to both technologies and has a large pool of digital talent to build on.

Today, the European Investment Bank (EIB) and European Commission published a new study on the state of play in artificial intelligence and blockchain technologies in the European Union: “Artificial intelligence, blockchain and the future of Europe: How disruptive technologies create opportunities for a green and digital economy.” The study was produced by the EIB’s Innovation Finance Advisory team in close collaboration with DG CONNECT under the InnovFin programme – a joint EIB and European Commission initiative to support Europe’s innovators.

Read the online summary here

Download the full study here

Artificial intelligence and blockchain technologies have the potential to revolutionise the way we work, travel, relax, and organise our societies and day-to-day lives. Already today, they are improving our world: artificial intelligence was crucial in speeding up the development and production of COVID-19 vaccines, while blockchain has the potential to not only disrupt the financial system, but also help us track and report greenhouse gas emissions better, optimise commercial transport and create genuine data privacy protection. The further development of both technologies – guided by ethical and sustainability principles – has the potential to create new pathways for our growth, driving technological solutions to make our societies truly digital and greener, and ultimately keep the planet habitable.

The report launched today shows that in comparison to major global competitors, the European Union is falling behind in developing and deploying artificial intelligence and blockchain technologies. To catch up, however, the European Union can build on its leading role in high-quality research and its vast pool of digital talent.

“The real added-value of artificial intelligence and blockchain still lies ahead of us – in industrial, business and public applications. This is where Europe can catch up and even take the lead,” said EIB Vice-President Teresa Czerwińska, who is responsible for the EIB’s innovation investments. ”At the same time, we need to make sure that the development of these technologies is focused and respects our European values. We need to increase our joint efforts. To make this happen, our study shows that amongst other things, we need to invest more and faster, especially in later-stage startups. With the EIB Group, EU countries have the ideal instrument at hand to boost and scale up the development of data-driven solutions, bring excellence in research to the market and help build a greener, smarter society and thus a stronger Europe.

“AI and blockchain technologies are critical for fostering innovations, competitiveness, and sustainable economic growth. They offer unprecedented opportunities as key enablers of the digital and green transformation. It is thus essential to boost investments in both the development and adoption of these breakthrough technologies in Europe,” said Roberto Viola, Director General of DG CONNECT, Directorate General of Communication, Networks, Content and Technology, at the European Commission.

Is the European Union keeping up in the global artificial intelligence and blockchain race?

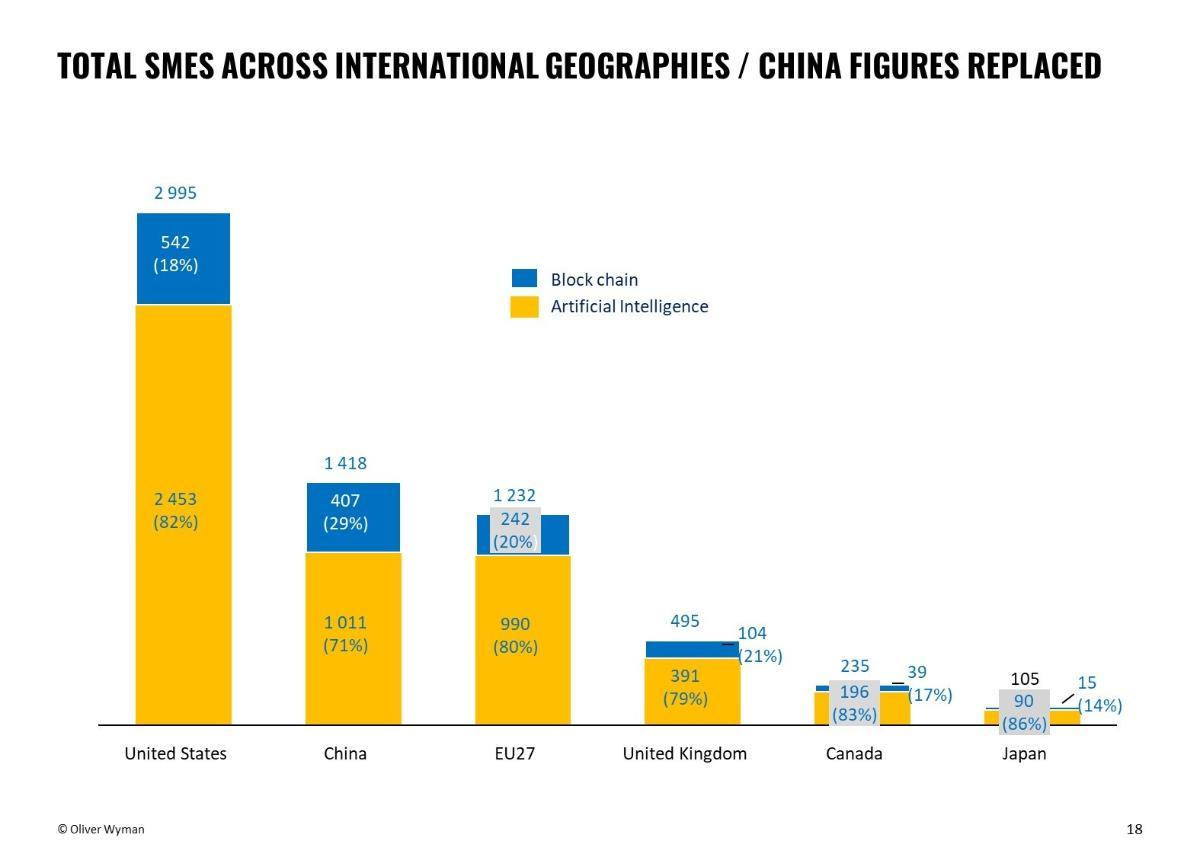

The study shows that the highest number of small and medium-sized enterprises (SMEs) involved in artificial intelligence and blockchain can be found in the United States (2 995), followed by China (1 418) and the EU27 (1 232). The United Kingdom is another notable player (495). Within the EU27, the highest number of companies is located in Germany and Austria, followed by southern Europe, France and central, eastern and south-eastern Europe (EU13).

For available financing, it already seems to be a two-horse race between the United States and China: together they account for over 80% of the €25 billion in annual equity invested in artificial intelligence and blockchain technologies, while the EU27 only accounts for 7% of this total, investing around €1.75 billion per year. Overall, according to the study, the estimated investment gap in artificial intelligence and blockchain technologies in Europe could be as much as €10 billion annually.

One explanation for this gap is the limited role played by large institutional investors such as pension funds, insurers and endowments in financing later-stage startups involved in artificial intelligence and blockchain.

Geographic breakdown of artificial intelligence and blockchain smaller and medium-sized companies, 2020

Source: Crunchbase data, Oliver Wyman analysis

Can the European Union catch up?

The study shows that the business environment overall in the EU27 harbours strong potential for competing with the United States and China. The EU27 has more specialised researchers than its peers, and typically produces the most technology-related academic research. Some Member States are performing strongly in the digital segment, indicating that the region is in a good position to deploy artificial intelligence and blockchain technologies across different sectors.

Europe also has the largest talent pool of researchers in artificial intelligence, with an estimated 43 064 in the field (of whom 7 998 are in the United Kingdom), compared with 28 536 in the United States and 18 232 in China.

What should the European Union do to catch up?

The study identifies three major areas that need to be addressed in Europe’s artificial intelligence and blockchain landscape. The challenges encompass development, market deployment and the wider EU innovation ecosystem. Accordingly, more financing needs to be made available for developing and scaling up EU businesses. It highlights the need of joint European efforts to pool financial resources from the public and private sector to support the scale-up of the most innovative AI and blockchain ventures in Europe. The deployment of both technologies also needs to be supported by backing their take-up on the market. And to expand further, Europe’s innovation hubs need to be better connected to increase the flow of talent, experience and funding access.

Read the detailed recommendations and the full report here

Explainer: What are artificial intelligence and blockchain?

Artificial intelligence, as the term tends to be used today, is the theory and practice of building machines capable of performing tasks that seem to require intelligence. Currently, cutting-edge technologies striving to make this a reality include machine learning, artificial neural networks and deep learning.

Blockchain is essentially a new filing system for digital information, which stores data in an encrypted, distributed ledger format. It is a transparent and decentralised way of recording lists of transactions. Because data are encrypted and distributed across many different computers, it enables the creation of tamper-proof, highly robust databases, which can be read and updated only by those with permission.

The opportunities presented by both technologies are very likely to be combined to create new products, services, assets or even forms of governance. Artificial intelligence can be seen here as the “thinking” part, and blockchain as the “remembering” part.

Background information

The EIB is one of Europe’s largest financiers of innovation, with investments in innovation, digitalisation and human capital of more than €230 billion since 2000. The EIB Group invested over €2 billion in AI core technologies and AI related applications, digital networks and projects in the past two years. The EIB also supports investments beyond the European Union.

About the InnovFin programme

"InnovFin – EU Finance for Innovators" is a joint initiative launched by the European Investment Bank Group (EIB and EIF) in cooperation with the European Commission under Horizon 2020. InnovFin aims to facilitate and accelerate access to finance for innovative businesses and other innovative entities in Europe. Please click here for the available products under the InnovFin programme.

InnovFin Advisory helps eligible public and private counterparties to improve the bankability and investment-readiness of large, complex, innovative projects that need substantial long-term investments.