- The funds, totalling €820 million, are earmarked for the infrastructure investment plan of i-DE, Iberdrola's electricity distribution company in Spain

- The project, which will maintain 10,000 jobs per year, is contributing to the electrification of the Spanish economy and to increasing the efficiency of the distribution network

- These additional resources will facilitate the execution of the company's strategic plan, focused on renewables and grids and in line with the REPowerEU plan

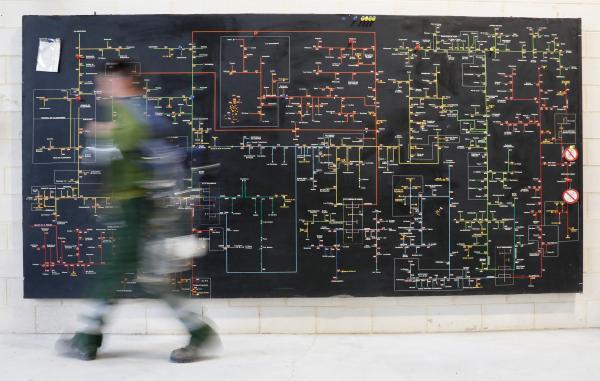

The European Investment Bank (EIB) and Iberdrola have agreed to increase the green loan signed in 2021 to support the development, modernisation and digitisation of the company's electricity distribution networks, a project with an impact on twelve Spanish regions. The €220 million top-up signed today brings the total EIB financing to around €820 million, allocated to strengthen smart grids in Spain and contribute to the further electrification of the economy. The project linked to the loan will improve the efficiency of the distribution network, characterised by automation and control.

With this loan, Iberdrola will boost recovery of the Spanish economy and employment by safeguarding around 10,000 jobs a year in Spain during the implementation period, according to the EIB's estimates. This loan supports the EU Bank's regional cohesion and development objectives, which give priority to promoting projects in less developed regions with a per capita gross domestic product (GDP) below the EU average. In this respect, 68% of the i-DE plan contemplated in this agreement is being developed in those Spanish regions.

This agreement supports the development of the smart grid investment plan being developed by i-DE, Iberdrola's distribution company in Spain, over the period 2021-2023, involving a total investment of €1.8 billion. The company will have the capacity to multiply the reliability, efficiency and security of the electricity distribution grid, all thanks to support from the EIB and Spanish government funds through the Recovery and Resilience Mechanism (RRM).

EIB Vice-President Ricardo Mourinho Félix said: "The top-up of this facility is all the more important at a time of energy crisis. We at the EIB know that it is vital to boost electricity grids in order to see the growth of renewable energy, which is vital for ensuring security of supply and decarbonising the EU economy. The top-up of this green loan with Iberdrola is a further step towards this objective, and it also translates into economic growth and employment in Spain".

The Chairman and CEO of Iberdrola, Ignacio Galán, explained that "the top-up of this green loan with the EIB will enable us to further develop Spain´s smart grids, which are essential for facilitating the integration of renewable energy production, boosting energy efficiency and improving the distribution network and the quality of supply. This will speed up the transition to a more sustainable model, helping to provide greater energy self-sufficiency and security, which are so necessary at this critical time".

In terms of the environment and energy, this operation is in line with the EIB's Climate Roadmap and the EU's REPowerEU plan strategy. The additional resources Iberdrola will receive will facilitate the implementation of the company's strategic plan, which focuses on investment in renewable energies and networks, two of REPowerEU's priorities.

The projects developed by i-DE also support the increased electrification of heating and mobility, in line with the objectives of the Spanish National Integrated Energy and Climate Plan (PNIEC) 2021-2030.

The EU Bank is carrying out this operation through a Green Loan. This is a type of financing whose characteristics fully comply with the requirements defined in the EIB's Climate Awareness Bonds (CAB) programme. The transaction is therefore eligible for allocation to its portfolio of lending operations financed through the issuance of CABs.

Iberdrola, a global leader in sustainable and green finance, has established itself as a global benchmark in sustainable finance, becoming the first group worldwide to issue green bonds, after being the first Spanish company to open this market in 2014. In 2016, the company also underwrote the first green loan for an energy company, in the amount of €500 million.

At the end of June 2022, the group already had green financing or financing linked to sustainability criteria amounting to more than €43,800 million, of which more than €16,500 million correspond to green bonds.