- Last year, the EIB Group invested €1.39 billion in 24 projects in the Netherlands, or around 0.15% of its gross domestic product.

- It granted loans for sustainable healthcare projects and innovative battery technologies, and equity-type financing for the first water innovation fund, in tune with the investment climate.

- The EIB’s 2022 investment survey reveals that 92% of Dutch companies surveyed plan to make investments to limit their CO2 emissions.

In 2022, the European Investment Bank Group, made up of the European Investment Bank (EIB) and the European Investment Fund (EIF), invested nearly €1.4 billion in the Netherlands. The top priorities were support for small and medium-sized enterprises (SMEs), healthcare modernisation and favourable financing solutions for innovation. In addition to almost €1.2 billion from the EIB, the EIF provided €271.4 million for projects in the Netherlands.[1]

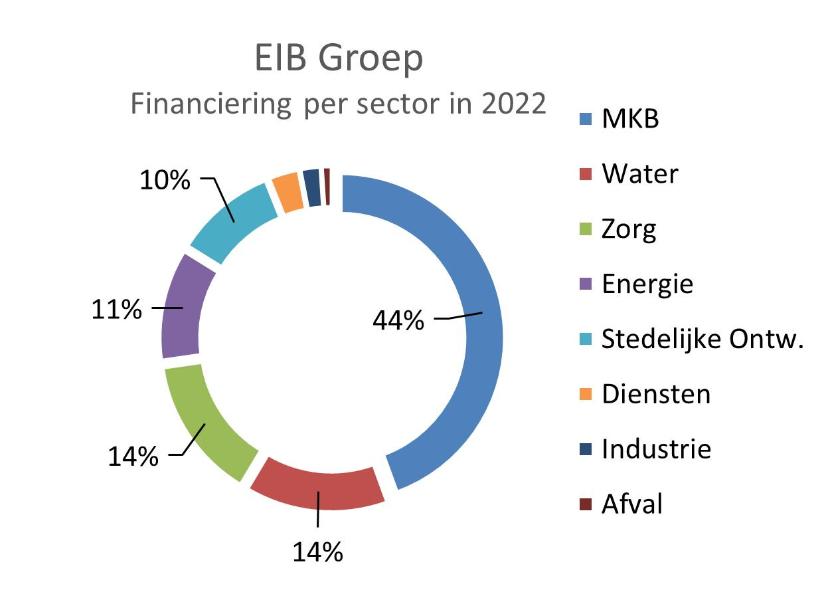

Small and medium businesses in the Netherlands accounted for around 44% of total investments. These included, for example, EIF investments in scaleup funds, and an EIB loan for Rabobank promoting impact loans for leading sustainable small businesses. The EIB also supported the Energiefonds Overijssel, which grants financing to small businesses on favourable terms for sustainable investments such as solar panel installation.

EIB Vice-President Kris Peeters said: “The EIB Group aims to invest where it is needed. Our investment survey helps us to identify where our value added has the greatest impact. Last year, we continued to proactively pursue the two key policy priorities of recent years — healthcare and drinking water supply. But our funding also made a difference in new areas. Projects such as the Energiefonds Overijssel, the innovative LeydenJar battery manufacturer and the PureTerra fund highlight the EIB Group’s strong commitment to its climate goals. Nearly 56% of our investments were climate-related, while the rest were all in line with the Paris Agreement. We expect to see more green projects in the coming years and are keen to support sustainable and innovative companies wherever we can.

Overall, some 55.9% of investments in the Netherlands in 2022 were directly linked to sustainability, climate and the environment. For example, three hospitals received financing for the construction of new energy-efficient buildings and to make existing buildings more sustainable, Vesteda improved the energy efficiency of its mid-market rental homes, and Brabant Water borrowed €200 million to make its drinking water supply more sustainable and climate resilient. The EIF also invested in PureTerra Ventures I, a new fund to support innovative companies in the water sector so that we can make better use of this scarce resource.

Results of the 2022 investment survey

In addition to the annual results, the EIB also publishes the results of its annual investment survey, which polls more than 12 000 companies on the investment climate, focusing on energy, employment and climate issues. In general, Dutch companies say they face fewer barriers to investment than in other EU countries. Most of them held up relatively well during the pandemic, but the Russian invasion of Ukraine and the subsequent increase in energy prices are worrying companies. The other main sources of concern are the availability of skilled labour and economic uncertainty.

Dutch companies are leaders on the digital front. They use technology far more than their peers in the rest of Europe, especially artificial intelligence, the internet of things and drones.

Kris Peeters explained that “Our annual investment survey is a very useful tool for the financial community and for public authorities. By comparing the national results with EU averages, other Member States, and a selection of companies in the United States, we get a clearer picture of the needs and opportunities of different firms. We can see that Dutch companies held up well during the pandemic and that their digital transition is already well on the way, which is a good sign. However, it is also clear that the climate will become an increasingly important issue. The EIB Group will continue to support Dutch companies through financing for renewable energy, sustainable solutions and energy efficiency.”

When it comes to fighting climate change, three-quarters of the country’s companies say they have already invested in this area, which is well above the EU average (53%). Almost all companies (92%) are also taking measures to reduce their CO2 emissions, for instance through cleaner technologies, sustainable transport and waste reduction and recycling solutions.

Nevertheless, businesses in the Netherlands appear to be less likely to invest in new products or services (18%, compared to the EU average of 24%). Similarly, the percentage of those who can be classified as “active innovators” is low compared to the EU average (13% vs. 18%). More than half of Dutch companies (57%) have not made any investments at all in research, development and innovation, compared to 49% for the European Union as a whole.

The full report is available here.

Background information

The European Investment Bank (EIB) is the long-term lending institution of the European Union owned by its Member States. The Netherlands holds 5.2% of the shares. Over the last five years (2018-2022), the EIB has made more than €9.8 billion available for projects in the Netherlands.

The European Investment Fund (EIF) is part of the European Investment Bank Group. Its central mission is to support micro, small and medium-sized enterprises by helping them to access finance. The EIF designs and deploys venture capital, growth capital, guarantee and microfinance instruments specifically targeting this market segment. Its activities contribute to EU objectives promoting innovation, research and development, entrepreneurship, growth and job creation.

At its annual press conference in Brussels on 2 February, the EIB Group unveiled its new logo, which aligns the Bank’s visual identity with the other EU institutions. It is based on two elements: the European flag and a stylised representation of the EIB Group headquarters building in Luxembourg.

[1] One operation with Rabobank involved an EIB counter-guarantee on an EIF guarantee. To avoid duplication, this amount was deducted, bringing the total to €1.39 billion.