- 77% of companies from Central and Eastern Europe (CEE) say they are investing in business development.

- The share of companies investing in product and service innovation in CEE is higher than in the European Union (27% vs. 24%).

- The main barriers to investment are the uncertain macroeconomic situation (87%), rising energy costs (87%) and the shortage of skilled labour (82%).

The European Investment Bank (EIB) has published the results of a survey on the investment levels in CEE companies — “Business Model Update: Are CEE Companies Investing Enough?”. The analysis was published as part of the Warsaw School of Economics (SGH) Report, which is to be presented at the Economic Forum in Karpacz (5 to 7 September 2023). The findings show that investment activity is recovering after the crises caused by the coronavirus pandemic and the war in Ukraine. Companies are trying to break away from the old capital-intensive growth model and are looking for new opportunities in this regard, especially those related to the use of modern technologies and innovation. The level of investment in enterprises in the CEE region (77%) is close to the average in the European Union (80%) and the United States (81%).

EIB Vice-President Teresa Czerwińska remarked, “Investment by CEE enterprises in product and service innovation is higher than the EU average. This is a positive trend that will accelerate the development of the region, create new jobs, and certainly increase the region’s competitiveness on the international market.”

“Enterprises in the CEE region, after the crises caused by the coronavirus pandemic and the war in Ukraine, are returning to the path of growth. The vast majority of investments involve the replacement or expansion of production capacity, which will allow enterprises to become more efficient and more environmentally friendly in future,” said EIB Chief Economist Debora Revoltella.

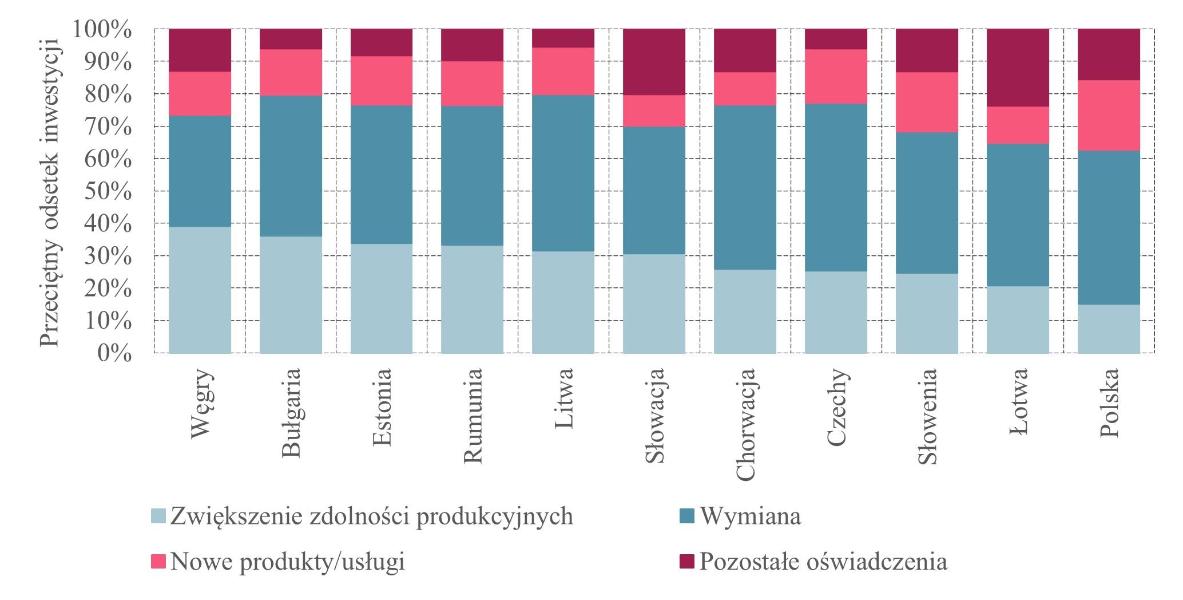

The main investment aim of companies located in the CEE region remains capacity replacement — the same as the EU average (46% of companies in CEE countries and in the European Union). This is followed by capacity expansion (25% of companies in CEE) and innovation (17%). Manufacturing companies (20%) and large organisations (18%) invest relatively more in innovation. Companies from Poland (22%), Slovenia (19%) and the Czech Republic (17%) allocate the greatest share of funds to innovation, investing in the development of new products or services.

Allocation of investment in the last financial year by country (%)

Question: What proportion of your total investment was spent on: (a) replacing production capacity (including existing buildings, machinery, equipment, and IT); (b) expanding production capacity for existing products/services; (c) developing or introducing new products, processes and services? Basis: all companies that made investments during the last financial year (excluding “don't know” responses and companies that declined to answer).

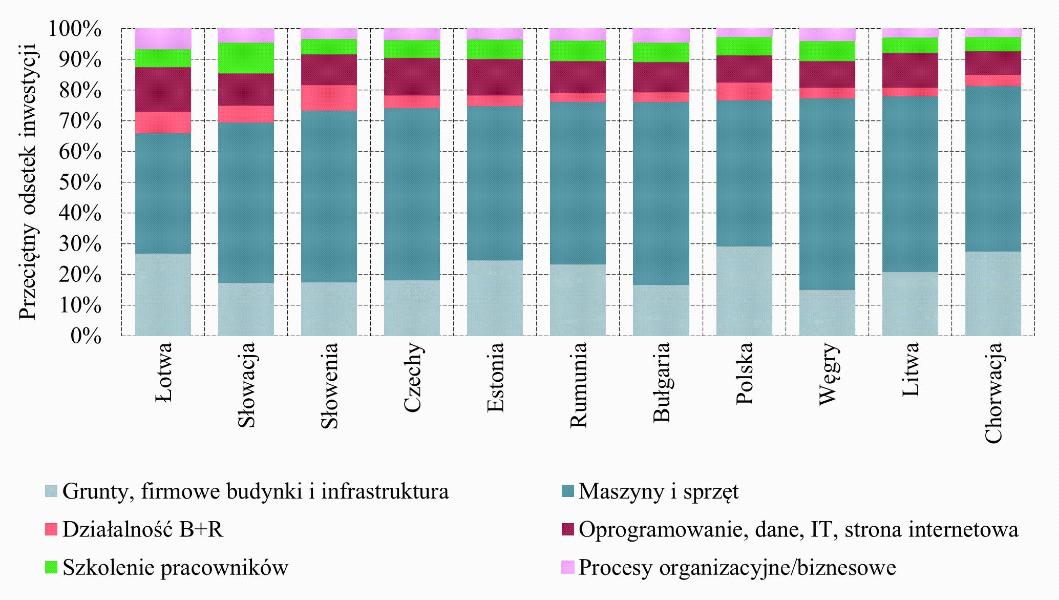

In contrast to EU and US companies, those operating in the CEE region allocated a bigger share of their investment to machinery and equipment (53% vs. 49% in the EU and 47% in the US), and a smaller share to intangible assets (24% vs. 37% in the EU and 33% in the US). The share of companies intending to focus primarily on product and service innovation in CEE (27%) exceeded the result recorded in the EU (24%) and the US (21%) in this regard. Innovation is an especially important investment priority for manufacturing firms and large companies.

In particular, machinery and equipment dominated the investment expenditure of manufacturing (60% of investment expenditure) and construction companies (59%), while service companies invested relatively more in digital technologies (18%). The share of investment in intangible assets was highest in Latvia, Slovakia, Slovenia and the Czech Republic.

Investment areas by country (%)

Question: In the last financial year, how much did your company invest in each of the following areas with the intention of maintaining or increasing future profits? Basis: all companies that made investments during the last financial year (excluding “don't know” responses and companies that declined to answer).

The most frequently cited long-term barriers to investment in the CEE region are uncertainty about the future (87%), energy costs (87%) and availability of skilled workers (82%). The average results for the European Union are similar.

Impact of climate change on investment

Companies in the region are concerned about the cost of taking zero-carbon measures, which for businesses means modernising production methods. Due to the high proportion of fossil fuels in energy production in CEE countries, and to energy-intensive production methods, enterprises in the region are particularly exposed to this risk. As a result, the share of CEE companies that see the transition to more demanding climate standards and regulations as a threat is higher than the percentage of those that see this process as an opportunity (36% and 18%, respectively). These figures contrast with the overall situation in the European Union, where the shares are almost the same (threat: 32%; opportunity: 29%). Compared to small and medium-sized enterprises, many more large enterprises view the transition to zero-carbon as an opportunity (14% vs. 22%).

CEE companies are taking steps to adopt a more environmentally friendly business model. Nearly 90% of companies in the region are aiming to reduce greenhouse gas emissions, which is in line with the EU average. The main projects undertaken in this regard in CEE countries are waste reduction and processing (67%) and investments in energy efficiency (55%), which have proven very profitable in recent years. Compared to the EU average, CEE enterprises invested less frequently in sustainable transport (43% vs. 32%). Across the region, companies in Romania (93%) and Poland (90%) were most likely to undertake such projects, while companies in Bulgaria were less likely (70%).

The percentage of CEE companies investing in energy efficiency (nearly 40%) is close to the EU average, despite the fact that the region favours a more energy-intensive business model. Companies in the manufacturing sector (48%) and large organisations (50%) were most likely to undertake such investments.

Investment financing

Own funds (70%) accounted for the largest share of financing among CEE companies in 2022, followed by external sources (25%), with group financing accounting for an average of 4% of overall corporate investment in CEE countries. The percentage of companies using external financing is highest in Romania (32%) and lowest in the Czech Republic (18%).

Three-quarters (75%) of the companies that say they use external financing obtained bank loans in the last financial year, of which 21% obtained a loan on preferential terms. There are significant differences in this regard between countries in the region: Preferential bank loans are most common in Hungary (39%), the Czech Republic (36%) and Romania (36%), and least common in Latvia (5%), Poland (7%) and Estonia (8%).

The proportion of companies experiencing financial difficulties in obtaining external financing is higher in CEE countries (9.2%) than the EU average (6.2%). The main problem reported by companies in the region was the rejection of loan applications (5.8%).

General Information

About the EIB Group Investment Survey

The EIB Group Investment Survey is the EIB’s annual flagship report. It is designed to serve as a monitoring tool that provides a comprehensive overview of the changes and factors driving investment and its financing within the European Union. The report combines the EIB’s internal analysis with the results of collaboration with leading experts in order to explain key market trends and provide a more in-depth look at specific topics. The 2022–2023 survey reflects the EU economy’s resilience to repeated shocks and its capacity for renewal, delivering on the promise of productive public and private investment. Featuring the results of the EIB’s annual investment survey, the report presents the responses of around 12 500 companies across Europe to a wide range of questions about corporate investment and investment financing; it also includes a survey of EU municipalities.

The EIB Group is the long-term lending institution of the European Union, owned by its Member States. It consists of the European Investment Bank and the European Investment Fund. The EIB Group provides financial support for investments that contribute to EU policy goals, such as social and territorial cohesion and a just transition towards climate neutrality.

The EIB is the first multilateral development bank to move away from financing projects connected with fossil fuels, and has pledged to support €1 trillion in climate investment over the course of this decade. More than half of the loans granted by the EIB Group in 2022 were for climate and environmentally sustainable development projects. At the same time, almost half of the projects financed by the EIB within the European Union were located in cohesion regions (i.e. regions with lower per capita incomes), underlining the Bank’s commitment to equitable growth.