- The EIB Group signed nearly €2.7 billion in new financing for 31 new projects in the Netherlands and invested nearly €88 billion worldwide.

- Globally, a record €49 billion went to green financing and more than €21 billion to energy security. In the Netherlands, 52% of all projects were green.

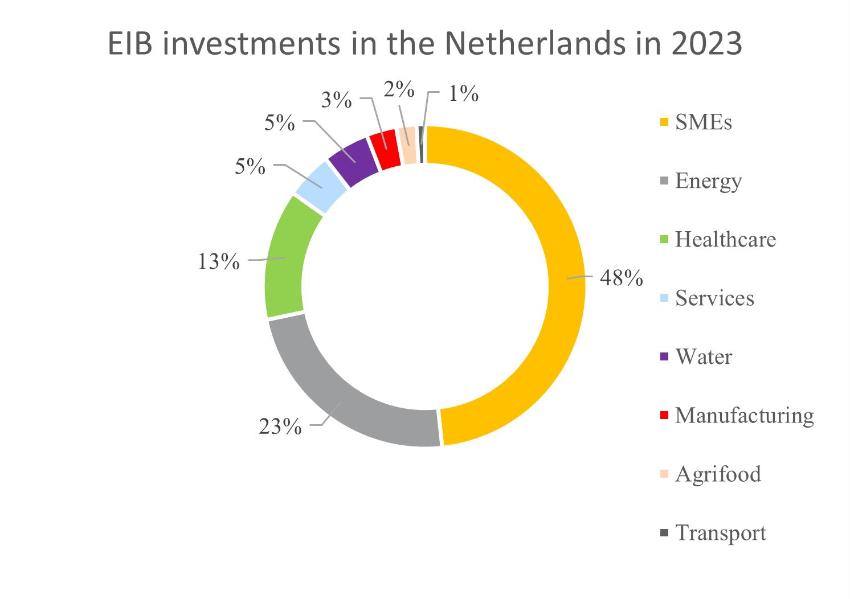

- In addition to large support for Dutch SMEs, the EIB’s main focus was on energy, healthcare and innovative projects, for example in the agrifood sector.

In 2023, the European Investment Bank Group signed nearly €2.7 billion in new financing agreements in the Netherlands. The European Investment Bank (EIB), with €2.137 billion in loans, financed 16 projects contributing to EU policy priorities such as climate action, sustainable infrastructure and healthcare, while the European Investment Fund (EIF), with €547.8 million in equity and guarantees, signed 15 transactions supporting small and medium-sized enterprises (SMEs) in the Netherlands.

Climate projects accounted for 52.2% of financing in the Netherlands last year, in line with the EIB Group’s goal of putting at least half of its annual investments into climate-relevant projects. The EIB loan of €0.5 billion to Enexis for reinforcing and expanding its electricity network, for example, was a significant investment. There was also strong support for a variety of innovative Dutch projects, such as Rocsys’ robotic charging technology for electric vehicles, Battolyser’s new battery type, and InOvo’s invention that may greatly improve animal welfare in the poultry sector. The EIF also supported forward-looking technologies by investing in funds such as the Future Food Fund II and the first Circular Plastics Fund, which finances new techniques that preserve the original properties of different types of plastics in the recycling process.

The importance of innovation among Dutch companies is also evident from the annual EIB Investment Survey released February 1st. Over half of the companies surveyed (56%) introduced a new product, process or service to the market last year. This puts the Netherlands well above the EU average of 39%.

“The Netherlands has a vibrant innovation landscape and the EIB is proud to contribute to its development. We also see a focus on initiatives that embrace sustainability. We financed various projects and clients, from pioneering battery technology to energy-efficient new construction in healthcare, and from agrifood innovation to sustainability loans for Dutch SMEs, all aimed at bolstering for the future. In addition, the EIF played a leading role last year by tripling the transaction volume in the Netherlands, which means more and better access to credit for SMEs,” said outgoing Vice-President Kris Peeters, who will hand over his mandate to the new Dutch Vice-President Robert de Groot from 1 February.

Since 2021, the EIB Group’s financing has supported €349 billion in green investments, putting it on track to meet its goal of enabling €1 trillion in green financing in the period through 2030. In 2023, €49 billion went to projects in climate action and environmental sustainability, up from €38 billion in 2022.

In 2023, the Bank invested more than €21 billion under REPowerEU, an initiative designed to reduce Europe’s dependence on fossil fuels and accelerate the green transition. The funded power generation facility can supply power to 13.8 million households.

Background information

The European Investment Bank is the long-term lending institution of the European Union owned by the Member States. The Bank finances sound investments that contribute to EU policy goals, including a global, equitable transition to climate neutrality. For more information on the EIB Group’s activities in the Netherlands, please visit our website.

The European Investment Fund (EIF) is part of the European Investment Bank Group. Its main objective is to support micro, small and medium-sized enterprises by helping them to access finance. The EIF designs and develops venture and growth capital, guarantees and microfinance instruments that specifically target this market segment. In this role, the EIF contributes to achieving key EU policy goals such as competitiveness and growth, innovation and digitalisation, social impact, skills and human capital, and climate action and environmental sustainability.