- The EIB Group signed nearly €3 billion in financing for 32 projects in Sweden last year

- Financing for climate action and environmental sustainability hit 76.7% of the total EIB commitments in Sweden in 2023

- Swedish industry and energy remained a key priority, with very large support for Northvolt’s gigafactory, Ericsson, and the H2 Green Steel project

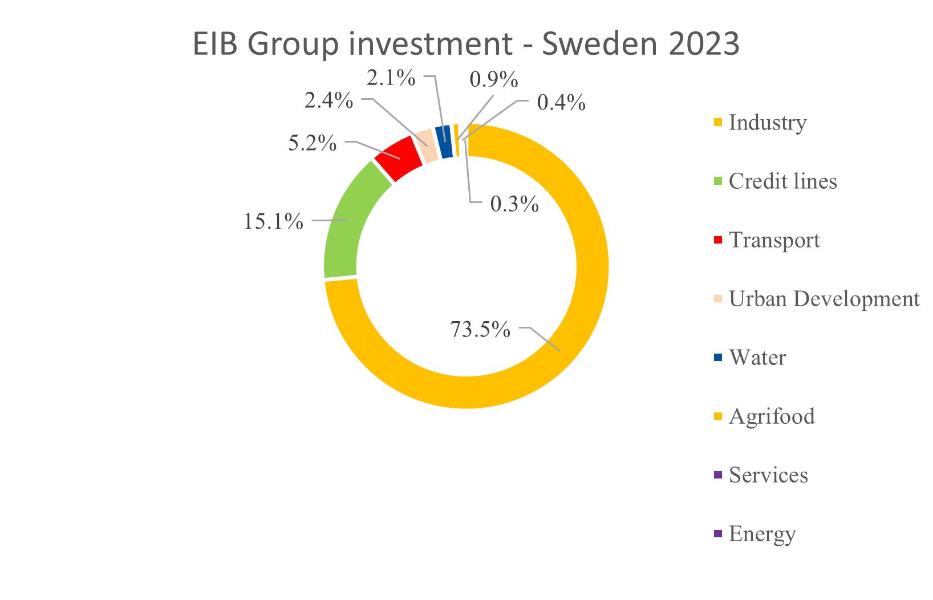

In 2023, the European Investment Bank Group (EIB Group) signed €2.91 billion in new financing contracts for projects in Sweden – an all-time record and equal to 0.53% of Sweden’s GDP. The EIB Group funded 32 different projects in the country, ranging from SME financing through the European Investment Fund, to high-profile investments for Northvolt’s gigafactory and H2 Green Steel by the EIB. Environmentally relevant projects made up the bulk of EIB Group financing in Sweden, as no less than 76.7% of the investment volume was committed in those.

With the EIB’s mission – to improve people’s lives – in mind, there was support for social housing in Skellefteå, while a SEK 1.75bn loan enabled the national railway company, SJ, to buy 25 high-speed trains for intercity connections. Swedish innovation also stayed in focus for the EIB, with financing for Exeger’s patented Powerfoyle solar cell, which harvests both indoor and outdoor light energy, paving the way for a wide variety of self-powered devices. A full list of EIB operations in 2023, including support for Volvo Cars’ transition to e-vehicles and Atlas Copco’s R&D, can be found on our website.

On the back of her first official visit to Sweden as EIB President, Nadia Calviño commented: “Sweden is leading some of our largest investments in new technologies for the green transition, including circular battery production and green steel. I look forward to exchanging views with Finance Minister Svantesson on how we can align our priorities more closely. I am glad that we can count on Sweden in providing concrete solutions for our common challenges.”

With backing from the European Commission’s InvestEU initiative, the European Investment Fund (EIF) – a subsidiary of the EIB – committed €445.6 million in equity investments, guarantees and inclusive finance transactions, which in time are expected to leverage over €2.8 billion in investments for the Swedish economy. Apart from investments in funds like Thrive, the EIF put up guarantees for Lisa&Friends, Ark Kapital and Norrlandsfonden, among others.

“Last year’s results show that Europe is more relevant than ever for Sweden.” said Vice-President Thomas Östros. “In a complicated geopolitical environment, the EIB made sure that Swedish projects could get the financing they needed. As the EU climate bank, we are committed to financing a just transition to a carbon-neutral economy. Although we know the transition won’t be easy, we are taking the risk on big projects that will have a long-term impact on our ecosystem because we know they are needed. We’re looking forward to engaging with Swedish businesses this year to see where our financing can be relevant, whether for big projects or small business financing.”

Regarding small businesses, the 2023 EIB Investment Survey, which was published today, shows that there is still work to do in that market segment. The proportion of financially constrained firms in Sweden is 7.2%, and although dissatisfaction among Swedish firms with most aspects of external finance is low, a fifth (20%) of firms express dissatisfaction with the cost of finance.

Background information

EIB

The European Investment Bank (ElB) finances sound investments that contribute to EU policy objectives. EIB projects bolster competitiveness, drive innovation, promote sustainable development, enhance social and territorial cohesion, and support a just and swift transition to climate neutrality.

The EIB Group, which also includes the European Investment Fund (EIF), signed a total of €88 billion in new financing for over 900 projects in 2023. These commitments are expected to mobilise around €320 billion in investment, supporting 400 000 companies and 5.4 million jobs.

All projects financed by the EIB Group are in line with the Paris Climate Accord. The EIB Group does not fund investments in fossil fuels. We are on track to deliver on our commitment to support €1 trillion in climate and environmental sustainability investment in the decade to 2030 as pledged in our Climate Bank Roadmap. Over half of the EIB Group’s annual financing supports projects directly contributing to climate change mitigation, adaptation, and a healthier environment.

Approximately half of the EIB's financing within the European Union is directed towards cohesion regions, where per capita income is lower. This underscores the Bank's commitment to fostering inclusive growth and the convergence of living standards.