How the European Investment Bank finances the transition to a more carbon-neutral energy mix

Clean energy lending is not only about protecting the environment. It is closely linked to creating jobs and improving quality of life. That’s why the European Investment Bank puts such an emphasis on its clean energy projects.

As the Board of Directors of the European Investment Bank approves our new energy lending policy, here’s an overview of how we have been financing the transition towards greener energy in recent years.

The transition to a carbon-neutral Europe requires investments that promote the use of electricity in transport and heating, instead of the more polluting fuels. It means financing for energy efficiency and renewable energy production capacity.

Fundamentally, the energy transition is about innovation. That could be new ways to store renewable energy or to improve electric vehicles.

How do these needs translate into numbers at the European Investment Bank?

Lately we have financed:

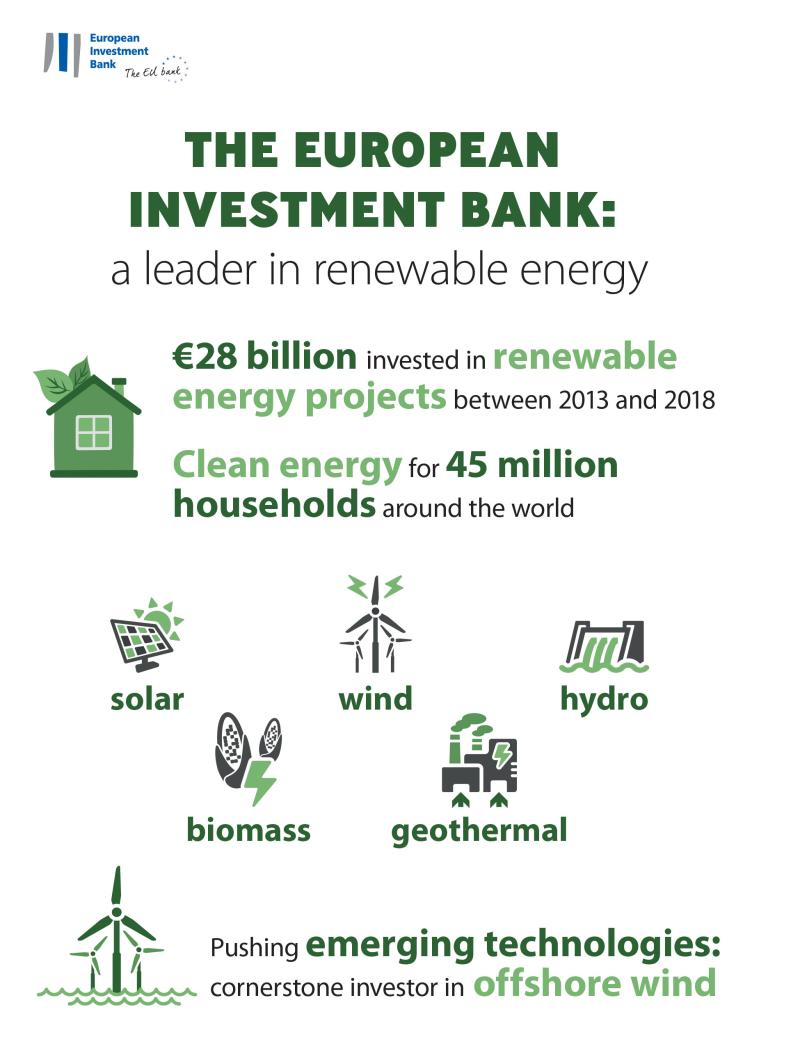

- €28bn in renewable energy projects in the period 2013-2018. These are expected to develop 38,000 MW of generation capacity, producing enough clean energy for 45 million households around the world

- €2.5-5 billion per year in energy efficiency projects, with a record year of nearly €5 billion in 2017

- around €4 billion per year in European electricity grids

Renewable energy production can come from wind, solar, hydro, biomass or geothermal sources. The European Investment Bank also plays a key role in supporting emerging and experimental technologies.

The greatest part of green energy comes from wind, where the European Investment Bank has been a pioneer and a cornerstone investor in offshore wind, an area initially seen as too risky by the banks. Since the early 2000s, European Investment Bank lending has helped reduce the costs of offshore wind and increase its deployment. The EU bank financed the earliest projects in Denmark and supported offshore wind roll-out across northwestern Europe, even during the financial crisis. Backed by the Juncker Plan, the European Investment Bank reinforced its support for offshore wind in recent years.

To date, we have financed 38 wind energy projects. That corresponds to more than 8 GW of offshore wind capacity. Under the InnovFin Energy Demonstration Projects Facility, we’re even supporting floating wind farms.

Electrification for carbon-neutral energy

As the demand for electrification of European energy increases, the EIB is financing numerous innovation projects in electric mobility, from research and development in the car industry to battery manufacturing and the deployment of a dense network of charging stations that will encourage people to switch to electric cars.

Greater use of electricity instead of other fuels needs a huge investment in electricity transmission infrastructure. That’s because wind and solar energy tend to fluctuate—there’s no solar energy at night and the wind doesn’t always blow.

Efficient carbon-neutral energy

The European Investment Bank is supporting efforts to increase energy efficiency everywhere from social housing to hospitals, and from schools to transport. The European Local Energy Assistance (ELENA) initiative provides cities with grants for technical assistance for energy efficiency measures. Since 2009, ELENA has awarded more than €160 million in grants, triggering an estimated investment of around €6 billion.

We’re also helping roll out smart meters in France, Italy, the United Kingdom, Spain and other countries, enabling tens of millions of consumers to better manage their electricity consumption.

Beyond the climate crisis, investments into green energy also address the problems of poverty, specifically energy poverty for millions of families struggling to pay their energy bills. For example, the Smart Finance for Smart Buildings initiative aims to make investment in energy efficiency projects in residential buildings more attractive to private investors. Up to 3.2 million European families could be helped out of energy poverty with this initiative, which also could create up to 220,000 new jobs.

Even before today’s board meeting, the European Investment Bank has targeted 25% of its financing at climate action—and the target will be even higher in our lending outside the European Union, at 35%. We have already been exceeding these targets (around 30% overall and 41.5% outside the Union in 2018. This gives us confidence that we can, indeed, achieve the ambitious goal of committing 50% of all our lending to climate action in the next decade.