Developing countries desperately want digital development. Let's show them where to click

By Werner Hoyer, President of the European Investment Bank

- President Hoyer at the Global Connect Initiative in Washington

What does connectivity mean to you? Maybe you'll think first of email and social media, or downloads of television shows and songs. Don’t forget shopping and banking—these days both involve the internet and expensive cybersecurity software. Imagine how your own job was performed 20 years ago. No doubt it has been transformed by digital communications. Perhaps it didn’t even exist before the developed world went online.

Now imagine all that went away. No smartphones, no apps, no internet. I expect you could get used to reading TV schedules again to find your favorite shows. But all the time you’d spend waiting for letters to travel through the mail or standing in line at the bank would have a tremendous economic cost. Superimpose that picture on a developing country, and you multiply the economic cost many times over.

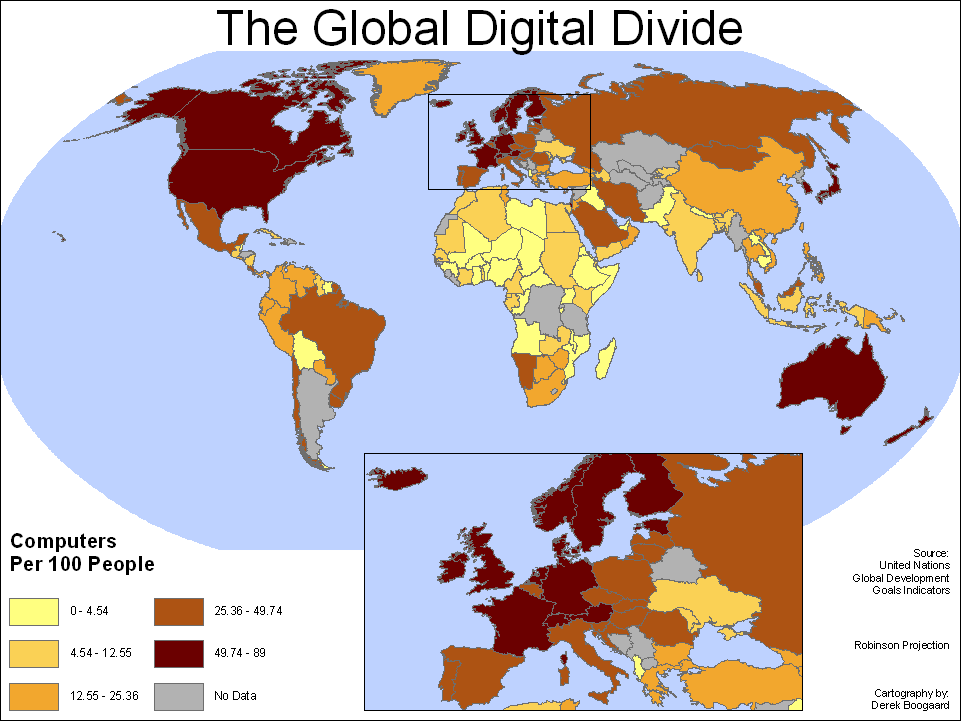

Connectivity is a crucial factor in the future prosperity of developing nations. In Sub-Saharan Africa, 240 million people are entirely without connectivity. That shuts them out of more than the services and application they are directly denied. Broadband access in developing countries often functions as a substitute for non-existent physical infrastructure and transport links. It is also a way to extend financial services to people who can’t reach a bank, allowing them to carry out current account transactions through their PC or mobile phone. The same is true of agricultural, social security, health and educational services.

That is why extending connectivity worldwide has long been a priority for both Europe and the US. In mid-April, I joined the leaders of other international financial institutions in Washington to offer our financing, experience, and expertise to a great new program called the Global Connect Initiative, launched by US Secretary of State John Kerry at the World Bank and IMF Spring meetings. The plan aims by 2020 to connect 1.5 billion people who currently have no online access. The task facing multilateral development banks is to work together to make investment in developing nations’ communications infrastructure attractive to private investors. It’s a big job, but it is to the benefit of us all.

The enormous cost of digital development

We cannot expect developing nations to fund their own emergence into the digital age—the financial hurdles are simply too high. The EIB has a 20-year track record of financing telecoms infrastructure, mostly in Europe, and a current exposure in the sector of more than $17 billion, making it one of the world’s largest lenders. Since 2008 we lent $22 billion to finance infrastructure and RDI in broadband, communications technology, and digital content. But Europe needs to spend $74 billion a year just to catch up with the US in broadband, data-centre capacity and cyber-security. Imagine how that figure looks to developing nations.

We need to build partnerships that can take the foundations we lay and erect upon them the massive investments the developing world needs. Partnerships with multilateral development banks, governments, and other international organizations. Partnerships with private investors. Because no matter what public investors do, connecting the world will remain an impossible task without private capital. So along with partnership among public investors, facilitating and appealing to private investment is the key to success.

Digital development with the Broadband Investment Fund

This was one of the major topics for discussion at the April meetings in Washington. You cannot build connectivity without making connections, and the alliances we build at these important meetings will be vital to hitting that 1.5 billion-person target.

At the EIB we think we have found a good framework. We are finalizing a new facility called the Broadband Investment Fund. The aim is to bring together public and private finance to put $570 million into small broadband investments, mostly in infrastructure for rural areas. Ultimately this facility could be replicated in developing countries. We look forward to exploring other schemes in partnership with other multilateral banks, international institutions and national governments, to make sure that limited public resources act as a seed for strong private financing.

Meanwhile, there are other things that need to be done. Regulations must be rationalized to remove barriers to investment and build the kind of stability and predictability that private investors need. Fair competition is the way to close the digital divide, for example by transparently auctioning telecom licenses to encourage new entrants and technological solutions.

Think of the world as a social network. Its value rises exponentially with the number of members, because you want to be able to connect with all your friends and business contacts. You can’t do that if everybody isn’t signed up, so you send out emails to your contacts inviting them to join. It’s time for rich nations to send developing countries the equivalent of those little emails. They’re ready to sign up. We just have to show them where to click.

(A version of this opinion article first appeared in Newsweek)