A sophisticated economic model gives a simple indication of the big impact of the EIB’s investments—and points the way to assessing the effect of the Investment Plan for Europe’s EFSI

This story of economic impact starts with the starkest kind of shock. Four years after the 2008 financial crash, EU gross domestic product remained below the pre-crisis level, fixed investment was down 15 percent, and long-term unemployment was on the rise. EU Member States asked the European Investment Bank to boost jobs and growth with an increase in its lending, granting it a EUR 10 billion capital increase.

By April 2015, the EIB had used this increase in capital to hit its EUR 60 billion target for additional lending. But once that investment was made, the Bank needed to figure out its effectiveness over time. This meant accounting for the complex interaction between those EIB operations and other activities in the economy.

EIB economists used a well-established economic model to assess the future impact of all its operations during the time of its capital increase. They found that the Bank’s lending is likely to have a considerable impact on Europe’s economy, adding 830,000 jobs by 2017 and 1.4 million by 2030.

“The model was developed to catch long-term factors, as well as short-term effects,” says Debora Revoltella, director of the EIB’s economics department. “That’s important to estimate the ultimate result for the real economy.”

The Bank’s economists are currently refining the model to assess the impact of the Investment Plan for Europe’s European Fund for Strategic Investments.

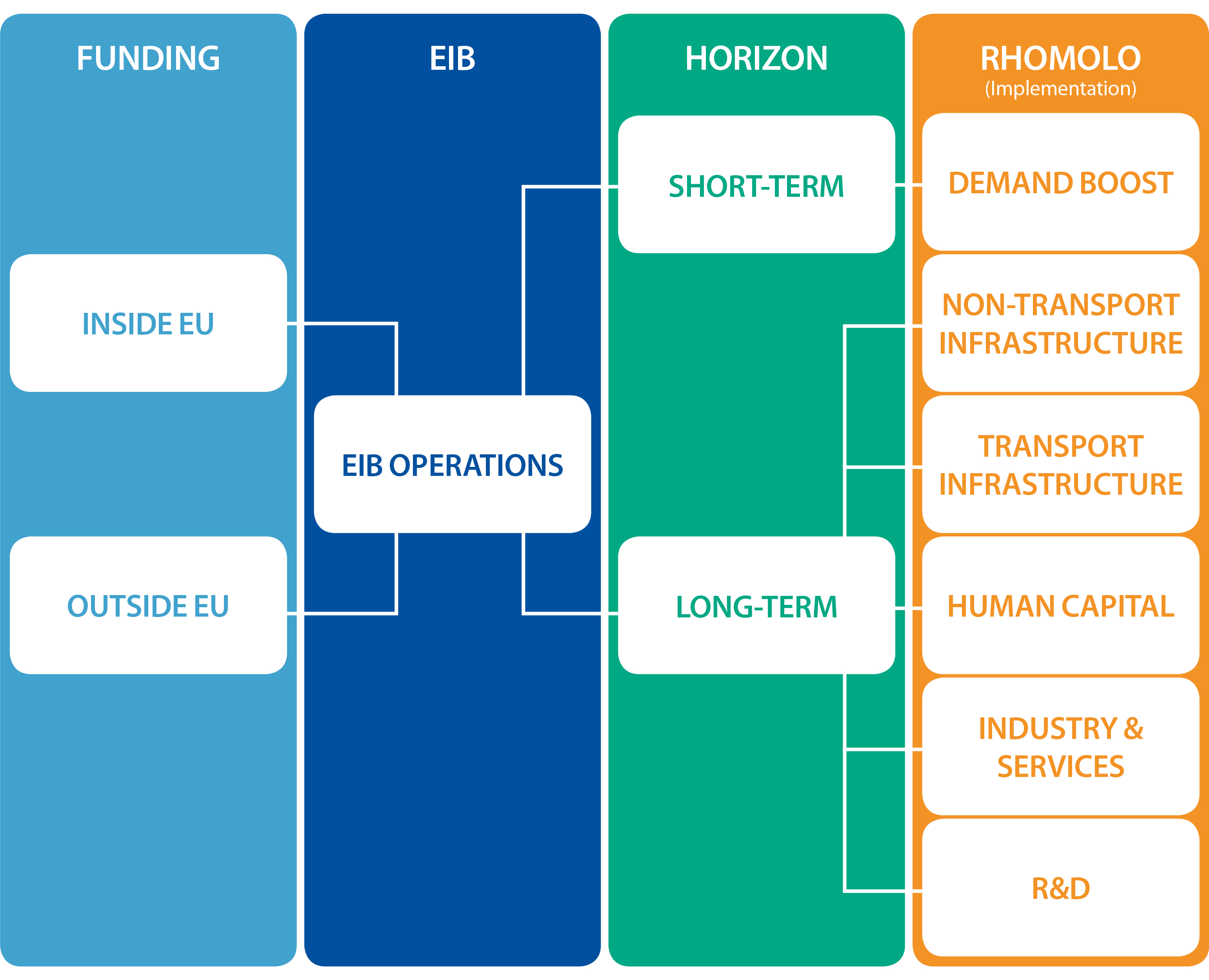

EIB impact model

The impact assessment of the 2013-15 capital-increase period provides many pointers as to how EFSI’s impact may be calculated, and also to the possible magnitude of the benefits additional investment will bring. That’s increasingly important now that European Commission President Jean-Claude Juncker has said he wants to double the size and timeline for EFSI.

EIB economists teamed up with the Commission’s Joint Research Centre in Seville to figure out the Bank’s impact during the capital increase. They worked with an economic model that was first developed in 2010 to assess the impact of EU structural funds, financial tools designed to cut the disparities between the economies of different European regions. The model, called RHOMOLO, calculated whether increasingly scarce public financing was being used effectively, making it a good fit with the EIB’s purpose.

“It’s a sound model and we’ve tried to use it in a conservative way,” says Georg Weiers, an EIB economist working on the assessment.

- EIB economists adapted the RHOMOLO model to show the impact of the Bank's work

One of RHOMOLO’s main strengths is that it captures:

• the short-term impact on economic activity

• how investment enhances productivity and, ultimately, growth in the longer-term.

For example, if the EIB finances a road, there is increased economic activity as the road is built. Once the road is complete, the EIB financing keeps on working, because the road reduces travel times and transport costs, thus increasing productivity, growth and job creation. To truly assess the impact of the EIB loan, both these factors have to be measured.

- An energy efficiency project in Paris financed by EFSI

EIB impact: the data

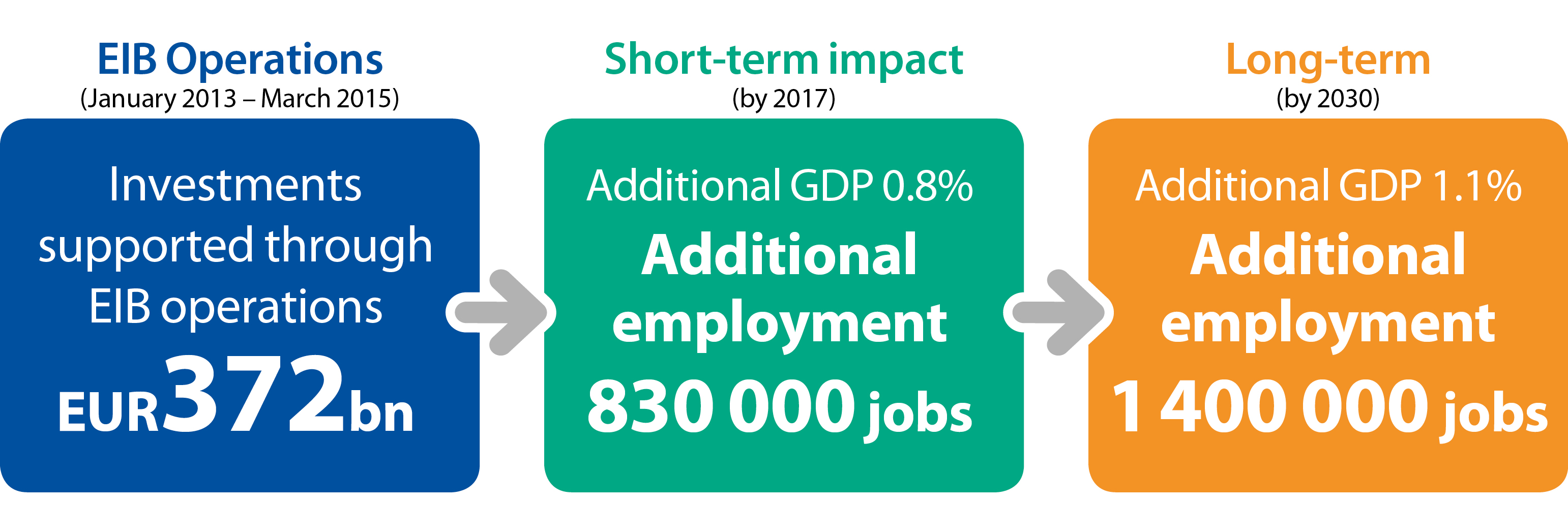

With this model, the EIB’s economists calculated the short-term and long-term impact of the EIB activities during the January 2013 to March 2015 capital increase period.

During the capital increase, regular EIB activities and those related to the capital increase amounted to 1024 contracts from 812 operations across the EU totaling EUR 142 billion. This helped finance total investment of EUR 372 billion.

The model estimated the short-term results by 2017 as:

• Additional GDP of 0.8%

• Additional employment of 830,000 jobsThe model projects the long-term impact by 2030 as:

• Additional GDP of 1.1%

• Additional employment of 1.4 million jobs

EIB impact and EFSI

It’s important for the EIB to assess its impact, so that it can ensure it makes its funds work effectively for EU citizens. As the EU bank, of course, it isn’t the only one looking at how its investments pay off. Already three prominent organisations have published impact assessments for the Investment Plan’s EFSI:

• The European Commission estimates EFSI will add as much as EUR 410 billion to EU GDP and 1.3 million jobs

• Oxford Analytica, an economic analysis firm, puts the GDP impact at 1.4%

• The International Labour Organisation predicts 1.8 million jobs through EFSI

- A digital printer at a store in Heidelberg, made by a German company that's backed by EFSI

EIB economists are working hard to adapt and refine the model to assess the impact of EFSI—as well as to produce impact figures that cover all EIB lending. “It’s a complicated model, because it’s quite sophisticated. It gives estimates of the overall effects in the economy, not just its direct effect,” says Revoltella. “But the result of this deep analysis gives a straightforward idea of the impact of the Bank’s work.”