The COVID-19 crisis has widened inequalities. To help less developed regions catch up, EU cohesion policy after the pandemic should address investment gaps by combining finance with capacity support for project planning and policies to lower investment barriers

By Patricia Wruuck, Julie Delanote, Peter McGoldrick, Emily Sinnott and Debora Revoltella

Increased divergence between people and regions across the European Union in the aftermath of the global financial and EU sovereign debt crisis led to serious concerns about a loss of trust in EU institutions, and in places ‘left behind’. Beyond the crisis-induced shock, pressure on inequality intensified as a result of megatrends, notably aging, digital technologies, global competition and climate change and pollution. Can this time be different?

The COVID-19 crisis has led to some widening of inequalities, for example in sectorally concentrated job losses or health outcomes by social strata. At the same time, it has triggered large public and EU support programmes to protect public investment and capital transfers, support firms and households, and mitigate risks of a protracted investment slowdown. What is more, the EU has committed to a joint agenda for recovery centred on green and digital transitions. The extent to which this will mitigate the risks of rising inequalities in the aftermath of the pandemic depends not least on support for cohesion.

Supporting cohesion in the post-pandemic environment

The European Union’s new cohesion policy aims to ensure that all parts of the EU can take part in the green and digital transition. Cohesion policy funds to boost EU economies’ ability to deal with longer-term structural shifts, together with the Next Generation EU funding package which aims to kick-start recovery, amount to over €1 trillion over 2021-2027. Yet the success in supporting economic catch up and convergence will depend on whether funds can be channeled to investments that effectively address gaps.

We use data from the European Investment Bank’s municipalities survey and the annual EIB Investment Survey (EIBIS) targeting firms across the EU to shed light on public and private investment needs, gaps and local abilities to advance on the transformation towards a smart and green economy. The analysis distinguishes between NUTS2 regions with GDP per capita below 75% of the EU average (less developed), between 75-100% (transition) and above (non-cohesion regions).

How are cohesion regions positioned?

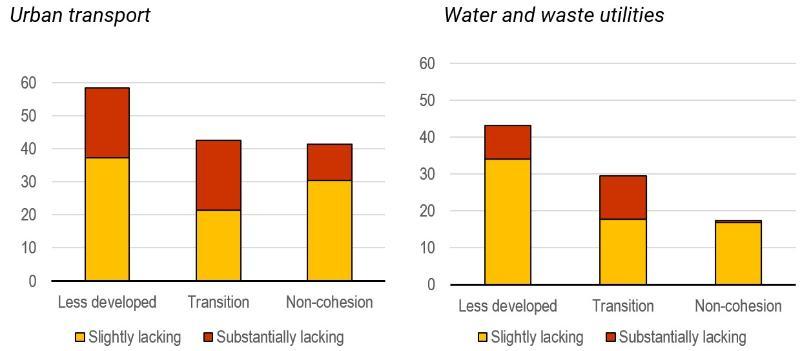

Our results show that lower GDP per capita tends to coincide with less adequate investment levels. Basic infrastructure gaps are more severe and common in cohesion municipalities, especially in less developed regions. Gaps are shown for basic infrastructure, notably urban transport, social infrastructure, and water and waste utilities (Figure 1). For example, non-cohesion municipalities are one-third less likely to report gaps compared to less developed regions. Fewer than 1% find that investment in water and waste utilities is substantially lacking, compared to some 10% for cohesion regions.

Figure 1: Municipal Investment gaps (percentage of municipalities reporting gaps)

Note: Question: “For each of the following would you say that the quality of infrastructure is satisfactory, slightly lacking or substantially lacking?”

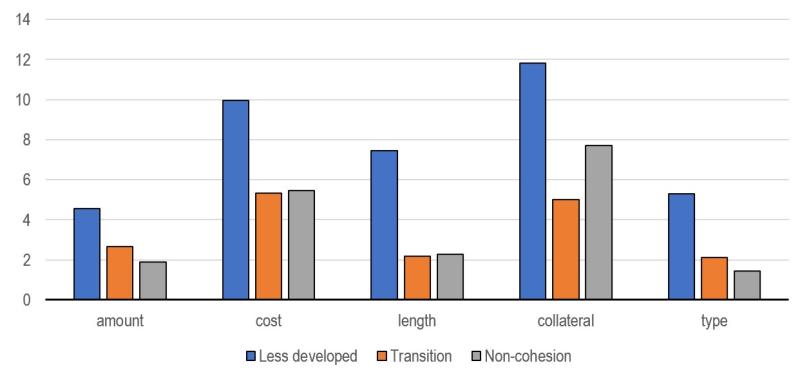

To move up the value chain, firms in cohesion regions will have to increase investment volumes and evolve their investment composition. Here, firms lag on investment in research and development and key intangibles. They also dedicate less of their investment to innovation-related activities. While more firms report having underinvested, signalling catch-up needs, EIBIS data shows that, in fact, fewer firms invest in cohesion regions (79% in less developed regions and 85% in transition regions compared to 87% in non-cohesion regions). At the same time, corporates in cohesion regions experience a more challenging investment environment, including greater difficulties in accessing finance (Figures 2 and 3).

Figure 2: Share of firms reporting obstacles by region

Note: Question: “Thinking about your investment activities, to what extent is each of the following an obstacle? Is it a major obstacle, a minor obstacle or not an obstacle at all?”

Figure 3: Share of firms that express dissatisfaction with financing conditions

Note: The base was all firms who used external finance in the last financial year (excluding don’t knows and refused). Question: “How satisfied or dissatisfied are you with…?”

Addressing the climate challenge

Municipalities and firms in cohesion regions show an interest in stepping up investment to address the climate challenge, but capacities are limited. Poorer municipalities’ needs for investment related to climate change are large. About 75% of less developed municipalities report investment gaps in climate change mitigation, such as for reducing emissions via energy efficiency, and in climate change adaptation.

Firms in cohesion regions show awareness of climate-related challenges but fewer have undertaken investment in energy efficiency measures (43% in less developed regions and 47% in transition regions compared to 49% in non-cohesion regions) and have a dedicated person in charge of climate change strategies (15%, 20% vs 24%).

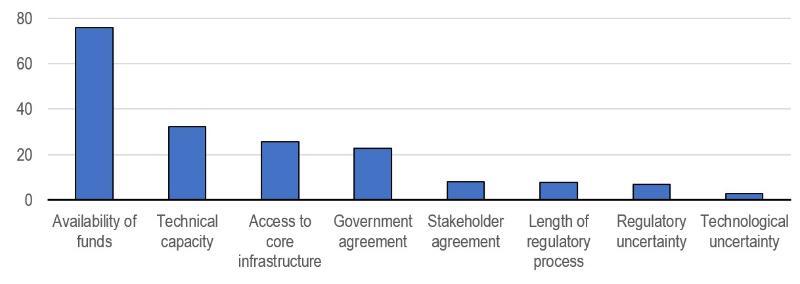

A lack of funding is an important barrier to addressing the climate challenge for municipalities and firms in cohesion regions. Three-quarters of municipalities identified a lack of funds as among the top two obstacles hampering investment in green infrastructure (Figure 4). For firms, finance, costs of investments and uncertainties about regulations are key obstacles to undertaking investment tackling climate challenges.

Figure 4: Municipal obstacles to green investment (percentage report as an obstacle)

Note: Question: “Thinking of green or climate related infrastructure investment, which are the two main obstacles to this type of investment?”

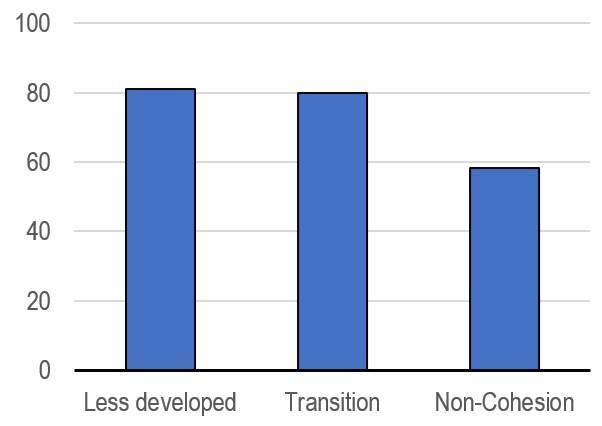

Taking on the twin transition will likely reveal capacity constraints in cohesion regions. Municipalities’ investment plans show that they are keen to close the gaps for green investment. However, more green projects will require innovation, navigating regulatory requirements, and mastering higher complexity. Yet, municipalities in cohesion regions lag in terms of green capacity (Figure 5). Similarly, for corporates, strengthening internal capacity to undertake green investment will be crucial for turning investment ambition on greening into reality.

Figure 5: Share of municipalities with limited green capacity (percentage)

Note: Question: “For your municipality’s infrastructure investments, have you included, do you plan to include or do you have no plans to include in the next 5 years, any of the following considerations or types of projects?”

What is needed to foster convergence?

Financing is needed to reduce investment gaps – but financing alone won’t be enough. To foster a sustainable economic catch-up for cohesion regions, policy support should focus on addressing basic infrastructure challenges in a climate-friendly way, supporting investment activities that help firms in cohesion regions move up the value chain, and jointly tackle finance and capacity gaps on planning and implementation to maximise impact.

Patricia Wruuck and Julie Delanote are economists at the European Investment Bank. Peter McGoldrick is a senior economist at the Bank. Emily Sinnott is head of the policy and strategy division in the economics department of the EIB and Debora Revoltella is the director of the Bank’s economics department.

The views expressed in this column are the private views of the authors and may not, under any circumstances, be interpreted as stating an official position of the European Investment Bank.