Poverty reduction and climate action now go hand-in-hand, because low-income countries are among the most vulnerable to global warming and the least able to adapt. An EIB tool for assessing the climate change risks developing countries face helps show where assistance is most needed

By Matteo Ferrazzi, Fotios Kalantzis, Sanne Zwart and Tessa Bending

As the EU climate bank and a major provider of development finance around the world, understanding climate risk is a core part of the EIB’s business. We track the carbon footprint of our projects and target measures to reduce emissions, and we screen all our investments to ensure that they are compatible with the goals of the Paris Agreement. Crucially, we also ensure that project design takes into account the risks posed by climate change. Recognising climate risk – and any consequent need for adaptation and mitigation – helps ensure that we do not miss opportunities to enhance climate resilience.

Understanding the dimensions of climate risk

It is important to be aware of how climate change and the climate transition could more broadly affect the economies and societies of the countries in which we operate. Among a number of economic analyses related to climate change, we have developed the EIB Climate Risk Country Scores, an index that carefully builds on existing data and cutting-edge studies on the impacts of climate change at country level[1]. The index allows us to compare countries to see where the overall risks are highest and where development intervention supporting climate change mitigation and adaptation can make the most difference.

For each country, we examine two main types of risk. Physical risk covers all the future impacts of the changing climate, including the risk of natural disasters (“acute risk”), as well as more gradual changes (“chronic risk”). Transition risks are policy and regulatory risks driven by the introduction of stringent climate policies to help countries achieve carbon-neutrality in line with the Paris Agreement goals. These climate policies affect the cost of doing business and the returns on domestic assets, increasing the likelihood of carbon-intensive assets becoming stranded.

Quantifying the physical risks posed by climate change

The physical risk scores are based on an estimate of the total annual burden each country faces in damages, costs and losses related to climate change. The scores are composed of the following elements:

- Acute risks of extreme weather events (storms, heatwaves, fog…) and other climate-related natural disasters (floods, landslides, droughts, wildfires, glacial lake outbursts, etc.)

- Chronic risks arising from long-term and gradual shifts in climate patterns, namely:

- Impacts on agriculture and food production

- Impacts of rising sea levels, itself the result of melting glaciers and ice sheets

- Impacts on the quality of infrastructure needed. Just as natural disasters pose acute risks for infrastructure (e.g. the risk of damage), so gradual changes in climate can place infrastructure such as roads, ports and telecommunication systems under higher strain, making upgrades necessary and increasing capital and maintenance costs

- The impact of higher temperatures on labour productivity, particularly for outdoor activity

To calculate such impacts, we draw on empirical studies and other academic research on the economic costs of climate events and changes, typically in terms of monetary costs or loss in percentage of gross domestic product.

In addition, the physical risk score incorporates an assessment of each country’s capacity to adapt to climate change. The more countries are able to adapt to reduce their vulnerability to climate change, the less severe are likely to be impacts they experience. Fiscal revenues and sovereign risk ratings are used as a proxy of each country’s financial capacity to adapt to climate change, while governance indicators and the level of human development are used as indicators of institutional capacity.

Quantifying the risks posed by the climate transition

In a similar way, the transition risk scores are based on an assessment of a country’s exposure to the economic changes implied by the global climate transition, and on their capacity to reduce the negative impacts of that exposure (mitigation capacity). Countries can mitigate transition risks by taking action to limit or reduce greenhouse gas emissions. The long-term economic impacts of the climate transition will be lower for countries that can swiftly shift to a lower-carbon development model.

Exposure to the transition is based on:

- Revenues stemming from fossil fuel business. These are expected to decline in the future due to stricter climate policies and changing consumer preferences

- Current greenhouse gas emissions performance. High emissions is likely to mean higher costs in the future as a result of higher carbon prices

- Mitigation capacity is based on three dimensions:

- Performance in deploying renewable sources of energy

- Performance in implementing energy efficiency improvements

- The level of commitment to tackling climate change, based on the “nationally determined contributions” each country has set under the Paris Agreement

Based on economic literature and econometric analysis, we have given these different components appropriate weights to create a composite indicator that reflects the transition risk country score.

Low-income countries are the most vulnerable to physical risks stemming from climate change

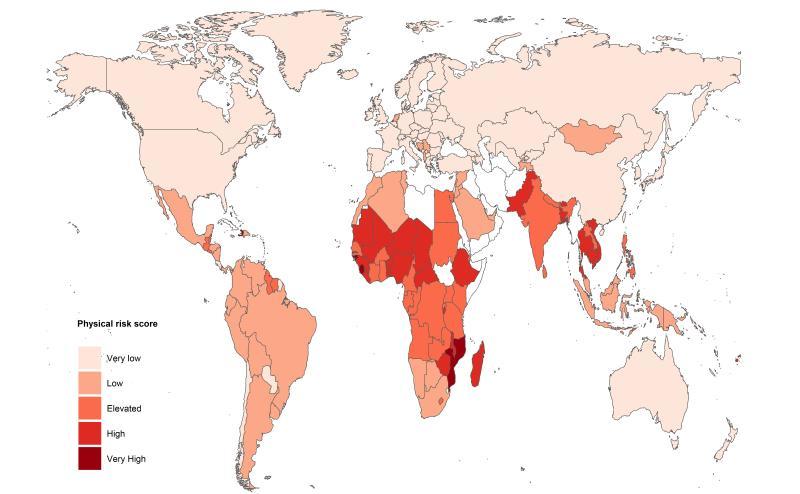

No country is immune to the impacts of climate change. Some countries and regions are much more vulnerable to the direct, physical effects of the changing climate than are others. The EIB’s physical risk country scores show very clearly the regions more at risk: sub-Saharan Africa, particularly the Sahel; South and Southeast Asian economies, particularly those with a high dependence on agriculture and low-lying coastal areas; and small-island nations in the Caribbean and Pacific.

EIB Climate Risk Country Scores: Physical Risk Score

The vulnerability of so many low and middle-income countries arises partly from their geographical and climate situation. Small island states in the Caribbean and Pacific are particularly vulnerable to hurricanes and cyclones, as well as sea-level rise. Many Asian and African countries are particularly vulnerable to long-term impacts on agriculture, as well as the impact of excessive temperatures on labour productivity. Many Asian and Southeast Asian countries are very vulnerable to sea-level rise, as are some coastal African countries.

The capacity to adapt to climate change and enhance resilience is also important. Many of the countries most exposed to the direct physical impacts of climate change are also among those least able to adapt. Sub-Saharan African countries stand out in this regard, while adaptation capacity in the Caribbean and Pacific is more variable. In fact, many less developed countries are so vulnerable to climate change partly because they are less developed. Poor quality infrastructure and housing amplifies the human and economic impact of natural disasters, such as hurricanes. Over-reliance on agriculture makes many people and economies very vulnerable. High levels of public debt and weak domestic revenue sources hinders timely investment in adaptation. People on low incomes with few savings and little capacity to borrow are very vulnerable to any kind of crisis.

That’s why poverty reduction and the decrease of climate change impacts now go hand-in-hand. Vulnerable low and middle-income countries need assistance to implement specific climate change adaptation measures, such as coastal protection or more resilient infrastructure. They also need more general development assistance to expand infrastructure provision, diversify their economies and raise incomes, something that would also make climate change impacts easier to manage in many cases.

High-income countries face the greatest transition risks, but mitigation is more challenging for low-income countries

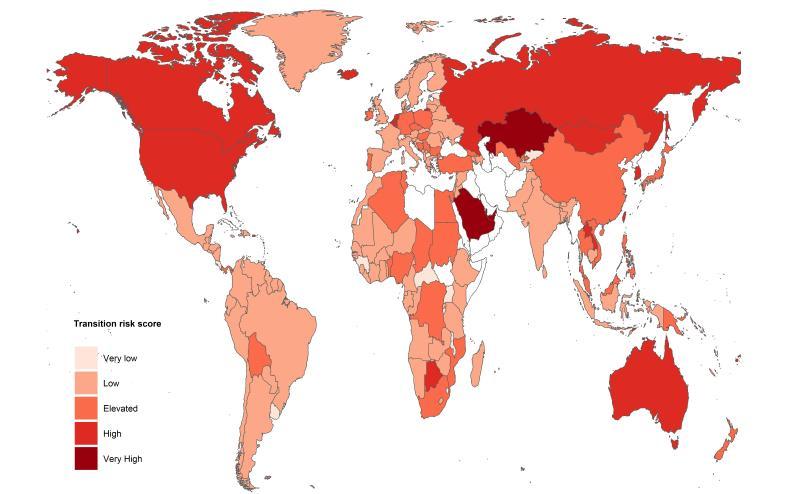

The EIB’s country scores for transition risk paint a different picture. Fossil fuel exporters are most at risk. High-income countries, which consume a large share of world resources and generate significant emissions, generally face higher risks from the transition to a low-carbon world economy. However, developing countries are expected to face higher transition risks in the near future, as they catch up with developed economies and their economic growth does not decouple from the greenhouse gas emissions.

EIB Climate Risk Country Scores: Transition Risk Score

That said, the transition risk for many low- and middle-income countries is still elevated, especially due to lower mitigation capabilities. The risks faced by some African countries like Chad, the Democratic Republic of Congo or Nigeria are higher than for some European countries. In some cases, this is because of high dependence on fossil fuel revenues. But it especially reflects weak mitigation capacity, with a slow penetration, so far, of renewables as energy sources and lack of commitment to change, with scanty financing also influencing this aspect. Moreover, even where transition risks are low, green investment in developing countries is still urgent. They need tremendous investment to fill infrastructure gaps, reduce poverty and create decent jobs in a way that does not lead to unsustainable greenhouse gas emissions. That development transition also has to be part of the global climate transition.

Green development finance needs to match the scale of the challenge

The climate risks faced by developing and emerging economies show how important it is that sufficient development finance for climate action is mobilised. That is where multilateral development banks such as the EIB have a vital role to play. In 2020, 30% of the EIB’s lending outside the European Union supported climate change mitigation and adaptation. As the EU climate bank, we are committed to devote 50% of our lending to climate action by 2025. This is vital, because development finance for climate action is still far below what is needed. Just over 10 years ago, developed countries committed to raising climate finance for developing countries to $100 billion a year by 2020. Latest estimates suggest that this target was not met[2].

Yet, the $100 billion target needs to be seen as a floor, not a ceiling. Now that we are past 2020, we need to set the target higher still, in line with the urgency and scale of the risks that developing countries—and the whole world—face from climate change.

Matteo Ferrazzi, Fotios Kalantzis, Sanne Zwart and Tessa Bending are economists at the European Investment Bank

[1] See Ferrazzi, M., F. Kalantzis and S. Zwart (forthcoming), “Assessing climate risks at the country level: The EIB Climate Risk Country Scores”, EIB Economics Thematic Studies.

[2] https://www.un.org/sites/un2.un.org/files/100_billion_climate_finance_report.pdf