Like many villages in Cyprus, Agros gets a vital lifeline for family businesses hurt by the island’s banking crisis

The Troodos Mountains, Cyprus’s highest peaks, cup the little village of Agros in a natural amphitheatre surrounded by terraces of grape vines and pink roses. But the mountains couldn’t shelter the 1,000 residents from the island’s financial crisis.

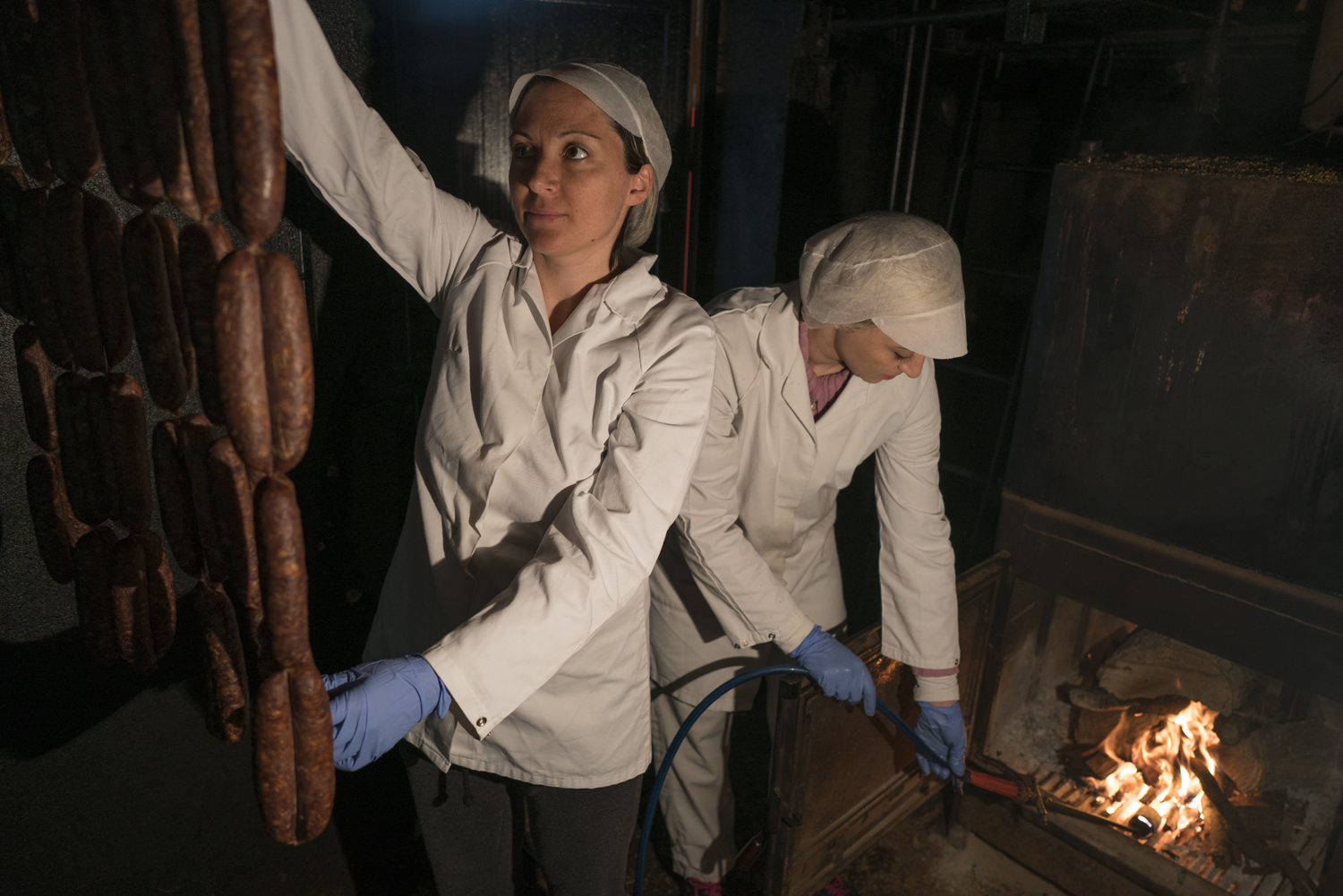

From 2011 to 2013, the crisis struck small business particularly hard. The European Investment Bank has increased its lending in Cyprus massively since then, and the small-business owners of Agros are among the beneficiaries. “If we did not have these loans, things would be really difficult for us,” says Georgia Kafkalia, who runs a smoked meats factory in the village with her parents and sister.

- Sisters Niki and Georgia Kafkalia in their meat factory in Agros, Cyprus

The EIB’s loans to Cyprus are mostly channeled through local banks and cooperative credit societies, which have close contacts with small-business owners like the Kafkalias. These small business loans helped take EIB support for Cyprus to 15 percent of its GDP in 2015. The Bank built relationships with 10 local banks in the last three years and by the end of this year expects to have signed EUR 475 million in financing for small Cypriot businesses, including EUR 175 million in 2016 alone.

“The high interest rate demanded by local banks was a big problem for small businesses,” says Nicos Yiambides, the EIB’s Cyprus loan officer. “We’re able to get financing to businesses at lower rates and longer maturities, and that has a very positive effect.”

- Agros, in the Troodos Mountains of Cyprus

Cyprus SMEs get better terms

Small businesses are key to the economic health of any economy. In a tiny village like Agros their success is even more important, yet access to finance is tricky when a business needs to expand or update its equipment. The Kafkalia family needed EUR 80,000 to buy new machinery for the room where they smoke their sausages, as well as new software and hardware for accounting and invoicing. Though they built relationships with customers over 40 years, “we have to invest to keep in operation,” says Georgia Kafkalia.

Even businesses that prospered throughout the financial crisis were hit by the high interest rates that followed. Costas Tsiakkas founded his winery with his wife 28 years ago and now employs 11 people. His sales increased in the year after the financial crisis hit. But when he needed to invest in the renovation of some of his terraces and irrigation systems, local banks demanded 9 percent interest.

Tsiakkas went to Troodos Cooperative Society, which gave him a EUR 100,000 loan that was financed by the agreement between the EIB and the Cooperative Central Bank in Nicosia. The Cooperative Central Bank’s loan, in turn, was financed by the EIB. The rate: 2.6 percent. “This loan opened my eyes that, yes, there can be a lower rate,” Tsiakkas says. “Our problem had always been the high rates.”

With current production at 160,000 bottles a year, it’s important for the local economy that Tsiakkas prospers, because he buys most of his grapes from nearby farmers. It’s also important for the future of his family. Two of his sons are currently training in wine-making and agriculture and Tsiakkas expects the other two to follow into the family business as well.

- The cellar at the Tsiakkas winery

Cyprus SMEs support local economy

- Dr Kostantinos Vrachimis of the Cooperative Central Bank

The Cooperative Central Bank acts as an intermediary with the EIB on behalf of Cypriot cooperative banks. The average loans is for EUR 100,000. All 18 local cooperatives have given Cyprus SMEs loans that originated with the EIB. “The impact of these loans is very big,” says Dr. Kostantinos Vrachimis, head of retail products development at Cooperative Central Bank. “Agros is very remote. These are family businesses employing local people, and many other business rely on them because they supply them with meat or fruit, for example.”

Vrachimis grew up in an agricultural village and feels a bond to the small businesses of Agros and other tiny communities. “I’m close to these places. I feel strongly about protecting the way of life there.”

Cyprus SMEs and island traditions

The traditions of Cyprus are often guarded by small businesses. In Agros, Niki Agathocleous keeps the flame for traditional desserts called spoon sweets, made with cherries, water melon, quince, walnuts or roses and served with thick, strong coffee. Her workshop uses traditional methods to boil the fruit—200 tons of it each year—and creates syrup flavoured with vanilla, cinnamon or cloves. She employs 25 people, mostly women, and sells largely within Cyprus for EUR 1 million annual revenues.

- Niki Agathocleous prepares “spoon sweets” at her factory in Agros

She took a EUR 20,000 loan from the Troodos Cooperative Society to buy new equipment and renovate some of her buildings. “It’s really important to invest and move forward,” says Agathokleous, who runs the business with her husband and two sons. “The financial crisis was a difficult time. But if you have somewhere to work, life will give back to you what you need.”

- The Kafkalia sisters outside their shop