Smart city investment in CESEE needs a boost all around compared to the rest of the EU, but some cities and regions are getting smarter

By Miroslav Kollar, Rocco Bubbico and Nicolas Arsalides

The significant “smartness gap” between regions in Central, Eastern and South-Eastern Europe (CESEE) and their counterparts elsewhere in the EU are particularly evident in innovation, accessibility, quality of government and quality of life.

Our study “Smart Cities, Smart Investment in Central, Eastern and South-Eastern Europe” demonstrates the infrastructure, productivity and innovation gaps and obstacles—as well as demographic challenges—faced by CESEE cities that want to follow the growing trend toward “smart cities.” The smart city approach uses digitalization, clean energy and innovative transport technologies to address the challenges that cities face, to allow inhabitants to make more environmentally friendly choices and to boost sustainable economic growth and innovation—while enabling cities to improve their service delivery.

Within the countries, the CESEE capital regions lag behind the EU average when it comes to smartness. Significant gaps emerge in governance and living quality. The capital regions perform significantly better than second-tier and other non-capital regions in societal factors, as well as technological consumption and business sophistication of companies. These intra-country regional disparities are much wider in the CESEE than those within other EU countries.

Increased investment is a necessary solution, but not enough alone. The whole EU is doing rather poorly on infrastructure investment planning. Where the CESEE municipalities lag behind the EU average is in the coordination of their investment projects with neighbouring municipalities, their region and with the networks of municipalities. This could result in inefficient planning and implementation.

The understanding of the specific gaps and the key areas of improvement compared to more wealthy areas of Europe and CESEE’s own capital cities is crucial for urban development policy, especially for digitally driven policies like smart cities. So, here’s what we found in more detail.

Infrastructure gaps

The EIB Investment Survey 1 shows that 40% of CESEE 2 cities still register gaps in basic infrastructure. A large share of CESEE cities reported under-investments over the last five years, specifically in transport and housing infrastructure, the areas where the quality of infrastructure is also lowest.

Regional economic data illustrates that most CESEE cities still lag behind the EU28 average, when it comes to productivity and innovation, while they also face demographic challenges. Over the last fifteen years, CESEE capitals have done much to catch up in economic and social terms, growing more quickly than other regions in their countries. This allowed CESEE capitals to converge quickly to average EU per capita income. Some of them even emerged as European economic hubs.

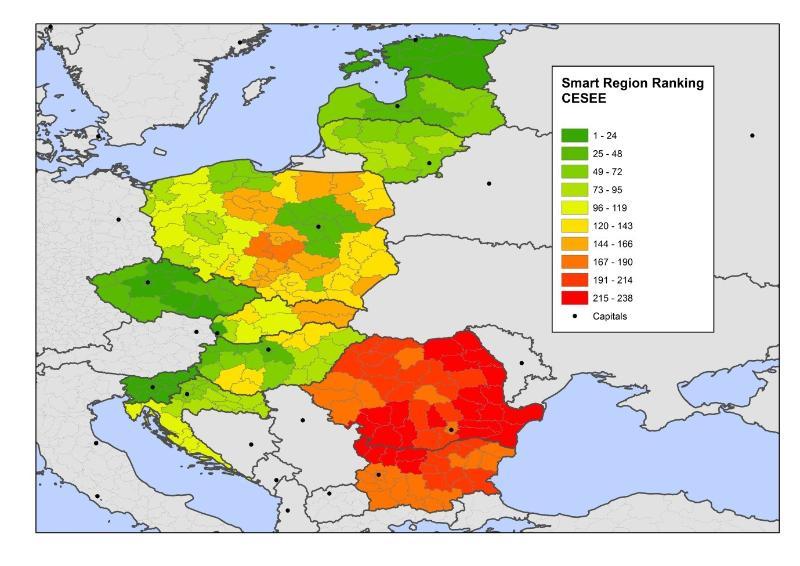

Chart 1: Smart region ranking (CESEE - ranking within CESEE)

Inequality, pollution and congestion pose challenges for cities and create collective costs in terms of quality of life, health and social cohesion. Against this backdrop, digital technology can support the trend of urban change, while helping reduce or eliminate costs in the following ways:

- provide many different options to local actors to increase efficiency of service delivery in a large variety of areas, from transport to energy and environment

- allow inhabitants to make more environmentally friendly choices, while enabling the growth of local economic agents

- generate a leap in service delivery, finding new and more efficient solutions to fill existing gaps in urban services, as well as making new investment less costly and more targeted to local needs and more future-proof

Pillars for smart regions investment in CESEE

We developed a Smart Region Index to examine the gaps in ”smartness” in the CESEE. We defined six main pillars of smartness so that we could identify and explore gaps in CESEE regions compared to the EU. This allows the identification of underlying factors and indicators that cause smartness gaps to emerge.

The six “smart” pillars are:

- economic dynamics and innovation (Smart Economy)

- environmental sustainability (Smart Environment)

- quality of administration (Smart Governance)

- accessibility (Smart Mobility)

- human capital (Smart Society)

- quality of life (Smart Living)

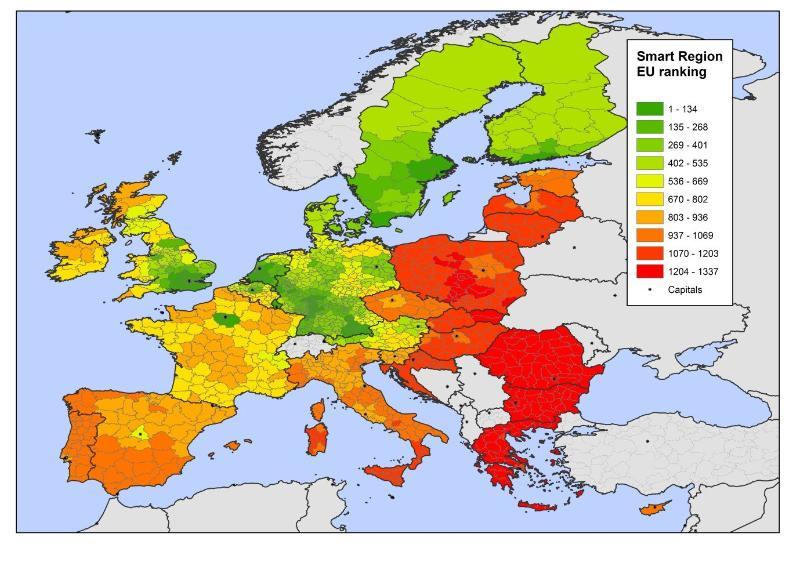

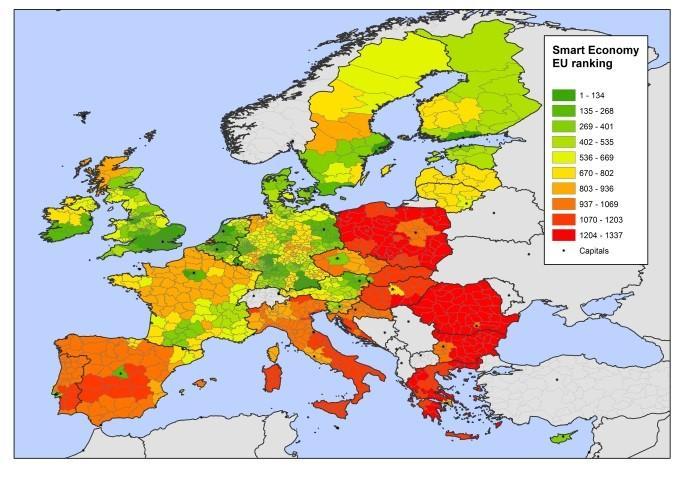

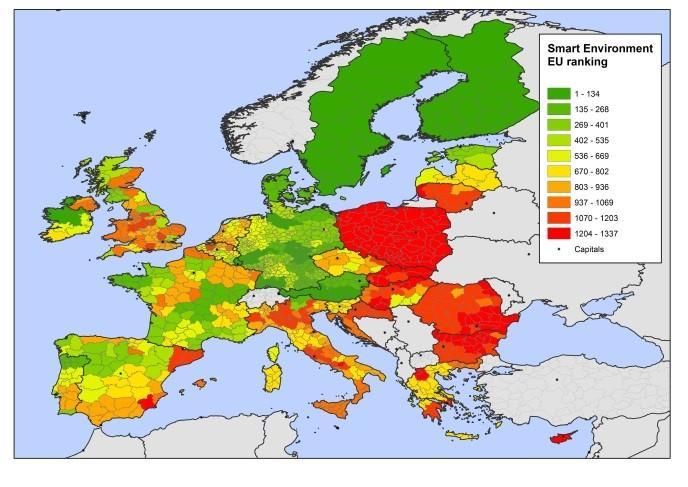

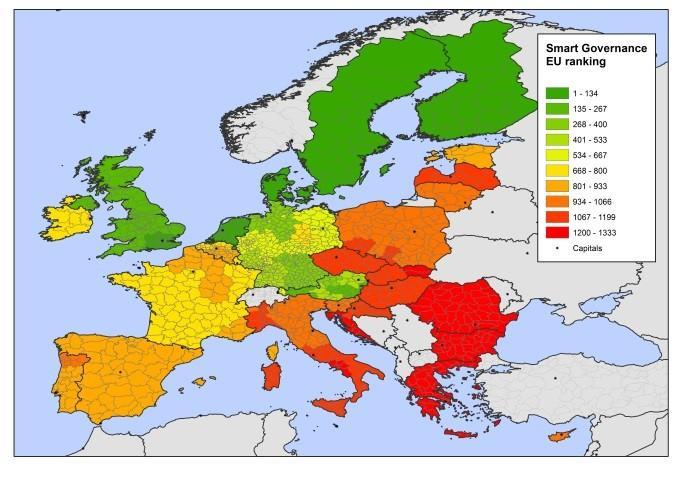

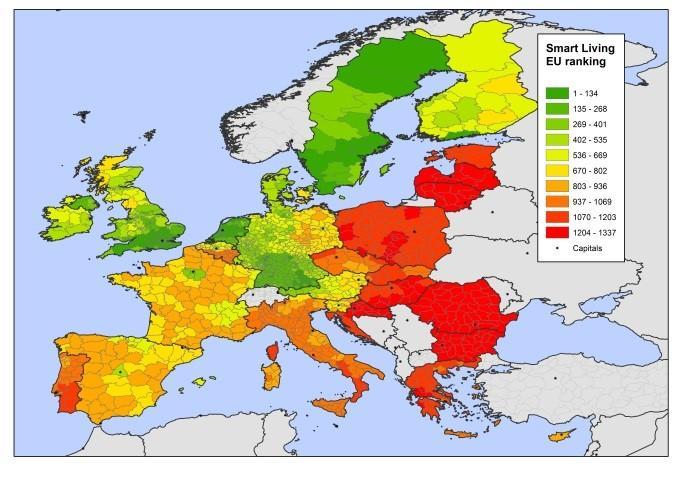

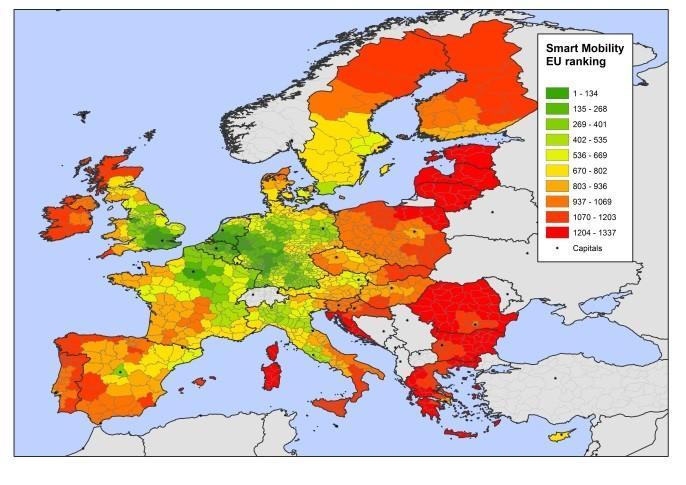

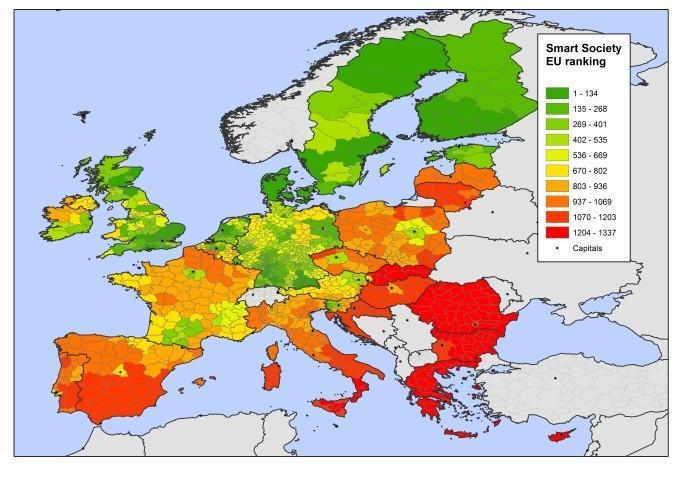

The analysis shows significant smartness gaps between CESEE regions and their EU counterparts (Chart 2), which are particularly evident in innovation, accessibility, quality of government and quality of life (see pillars in Chart 3).

Chart 2: Smart region ranking (EU-28

On average CESEE capital regions perform better than non-capital regions. But their smartness indicators still lag the EU average. Significant gaps emerge when it comes to governance and living quality aspects.

Capital heavy

Nevertheless, within the CESEE countries, the capital regions perform significantly better than second-tier and other non-capital regions, when it comes to societal factors, as well as firms’ technological consumption and business sophistication. In addition, the CESEE intra-country regional disparities are much wider than those within other EU countries.

Overall, within the CESEE, the highest smart scores came from regions in Slovenia, the Czech Republic and Estonia (see Chart 1). The capital regions of Slovakia and Hungary significantly outperform other regions in their countries.

Chart 3: Smart regions pillars (EU-28)

Opportunities for second-tier cities

Only a few cities in Europe can realistically become world-leading innovation hubs. But second-tier municipalities and those located in less-developed areas can become more efficient and more attractive. These cities can already offer better environmental quality, less congestion, and lower costs, but usually they cannot compete in terms of connectivity, qualified human capital and innovation capabilities with the largest metropolitan areas.

This is particularly evident in Central and Eastern Europe. The gap is much larger than in Western European countries. At the same time, both capitals and non-capitals lag behind their Western and Nordic peers.

Our assessment of the CESEE local fiscal health highlights the importance of the use of EU funds. Although investment in high-quality projects is essential to improve the territorial and social cohesion of Europe, this needs to go hand-in-hand with good governance. The EIB Investment Survey identifies these major obstacles to filling gaps in infrastructure project design and implementation:

- budgetary limitations

- the length of the approval process

- political and regulatory instability

- low technical capacity.

Limited access to finance hinders investment activity by municipalities, given that more restrictive fiscal responsibility schemes have recently been implemented in the region. CESEE municipalities are strongly dependent on European Structural and Investment Funds. Given this high dependence, EU funding reforms in the post-2020 Multi-Annual Financial Framework will be crucial for financing municipal investment.

EIB solutions for smart regions investment in CESEE

The EIB can provide the financing solutions for high-quality projects and the advisory services to upgrade the technical expertise of municipalities. Like their EU peers, CESEE municipalities perform poorly on the economic planning of infrastructure investment. They also perform worse than their EU counterparts in regional coordination of their investments. This shows that, according to the EIB Investment Survey, there is room for improvement when it comes to prioritisation and coordination of projects, so that municipalities can take advantage of the funds available for public investment.

Smart city investments can, therefore, help reduce capacity and efficiency gaps by meeting the basic infrastructure needs and by making cities more conducive to innovation and more attractive to people and businesses. This can be achieved by fostering coordination and prioritisation, by investing in capital cities and by developing second-tier cities with potential, giving them better links to the capitals.

Rocco Bubbico, Miroslav Kollar and Nicolas Arsalides are economists at the European Investment Bank.

1 European Investment Bank, “EIB Investment Survey 2017, municipal infrastructure”, 2017.

2 CESEE region covers (subject to data availability) the Czech Republic, Slovakia, Hungary, Poland, Slovenia, Croatia, Bulgaria, Romania, Latvia, Lithuania and Estonia.